To celebrate the continued existence of the blog, here a VREB-like upbeat take on our March numbers.

Marko provides us the early update.

March 2013

Net Unconditional Sales: 483

New Listings: 1,231

Active Listings: 4,333

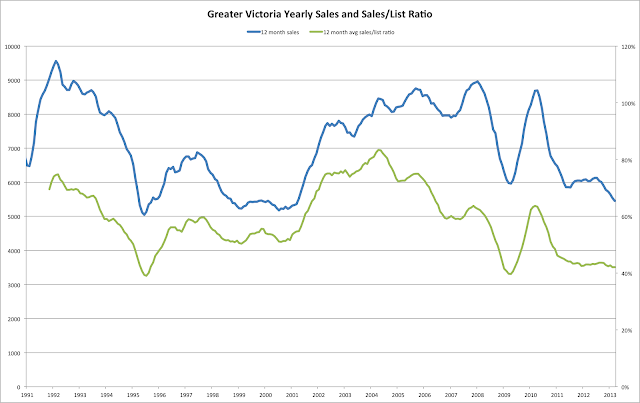

Clearly the sunny weather has brought out the buyers last month, with sales exploding by an amazing 22% over February. My friend a realtor says "We're definitely seeing some more traffic at open houses". Meanwhile with interest rates remaining low, it's never been a better time to buy in Victoria. Months of inventory at 9 reflects a balanced market in Victoria.

Update:

The

VREB release is out.

"The market continues to unfold as predicted," says Shelley Mann, President of the Board.

Hmm... What was that prediction again? Oh yeah: "sales volume will increase 4% this year over 2012, but prices will remain flat."

"With sales below the historical norm, there is potential pent-up consumer demand developing in the market. We expect quarterly activity to increase over the next two quarters"

Potential yes. But what's stopping those buyers? If they want to buy there is lots of selection, so I don't see why they don't go out and buy. It seems rather more likely that slow sales will create pent up supply, with people that maybe would have liked to sell last year or the year before for top dollar getting a little more serious.

"The first six months of 2012 were reasonably strong, and then mortgage amortization rules changed in July"

This is a bit of revisionist history. The first 6 months of 2012 were pretty weak, and then the year got weaker after July.

"With different lending rules in effect, it is challenging to compare the first six months of 2013 with 2012," she adds.

The median price of a single-family home is $510,777 compared to $555,000 in March 2012, a decrease of 8%. The six-month average shows a decrease of less than one percent month-over-month. Annual differences are skewed by four single-family home sales over $2 million in March 2012.

Challenging, but together we can do it! Those darn outliers, always shifting the median price, which as we know is especially susceptible to just that...