December 2012 month to date

Net Unconditional Sales: 278 (254, 186, 112)

New Listings: 399 (374, 294, 179)

Active Listings: 3894 (3979, 4118, 4215)

Sales to new listings ratio: 70% (68%, 63%, 63%)

December 2011

Net Unconditional Sales: 339

New Listings: 505

Active Listings: 3780

Sales to new listings ratio: 67%

Sales to active listings ratio: 9% or 11.2 MOI

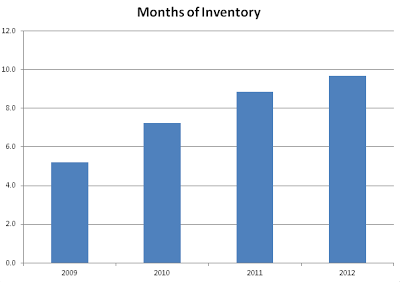

The number of deals closed today is likely under 10, so expect the month to wheeze to a close with less than 290 sales, or almost 15% under last year's already terrible sales rate. Listings have slowed similarly, with a sales/list at just over last year's number. Here's a quick recap of the last three years to show how the market has weakened.

Interestingly enough, the sales/list ratio this year was identical to last year, but the inventory and MOI continued to climb significantly. Less people taking their properties off market hoping for better days ahead and more people hanging on for that eventual sale.

Interestingly enough, the sales/list ratio this year was identical to last year, but the inventory and MOI continued to climb significantly. Less people taking their properties off market hoping for better days ahead and more people hanging on for that eventual sale.

61 comments:

And a look at strata re-sales for the last half of the month, suggests that the median and averages could be skewed considerably with the low sale volumes.

In Esquimalt, a two storey townhome along Lampson had this as its sales history.

$132,000 in April 2004

$239,477 in September 2007

$170,000 in December 2012

Similar to what happened to a condominium on Wark Street this month.

$157,900 in October 2004

$225,000 in January 2007

$200,000 this week

Again a similar roll back in prices for a condo in View Royal that showed this as its history.

$147,900 in Feb. 2001

$330,000 in Jan. 2008

$243,000 this month

Or a townhome along Craigflower

$498,600 in August, 2007

$468,548 this month.

On a re-sale basis, it does seem that strata home prices have rolled back to levels not seen since 2006 and 2007.

As for what is happening for strata condominiums in Victoria City proper, it's hard to say - there aren't any re-sales of stratas to check the market.

Leo, you cool if I use your charts in a video blog I will make tomorrow recapping the year?

Bring on the popcorn and see you next year! Keep up the great blog.

If you added 2009 sales numbers it would really show how much volume has dropped off. 2010 was already a poor year.

Happy New Year to all.

May the next year bring you health and happiness.

Happy New Year everyone and thanks to JJ and Marko for the numbers and Leo for the crunching. And of course to our esteemed host.

Have a great new year everyone.

Leo, you cool if I use your charts in a video blog I will make tomorrow recapping the year?

Sure. Updated charts to include 2009

Thanks for the charts, Leo. And for the continued numbers, Marko.

Really hard to argue with those charts. Cold, hard fact.

It may also be worthwhile to look at where the market has softened in relation to this month a year ago. (30 days numbers are back dated by one week from the end of the month)

Numbers in brackets are for December 2011

163 (198) house sales this year in the Core, Western Communities and the Saanich Peninsula.

82 (104) condominium sales in the same areas as described above.

The home sales were broken down as

97 (117) in the core

40 (56) in the Westshore

26 (25) in the Saanich Peninsula

Similarly condominiums are broken down as:

66 (85) in the core

9 (8) in the WS.

7 (11) in the Pen.

In my opinion, the core is taking the beating this year. As opposed to last year when the westshore was losing sale volume and the time to effect a sale was increasing.

It took a year, but it now seems that the contraction in home sales is into the core districts.

So, what's a million dollar home worth if you can't find a buyer for it?

That's an extreme example. A more reasonable question would be to ask - is there a difference between a $550,000 home that would likely sell in 30 to 90 days and the same home but now taking six months to a year to sell at $550,000?

It's a problem of liquidity. A home owner that does not have to sell, sees little difference between the two markets. A person that has to sell, knows there is a big difference between the two markets.

Happy New Year to all.

Marko: You can tell that lady who doesn't like junk mail/flyers, to tape a note in her personal mailbox stating: "No junk mail, thank you". The postperson will no longer stuff her box with the unwanted paper.

@Just Jack. Interesting breakdown.

Yep happy new year. Great graphing Leo. I think it is this spring that will tell all...

Here are my stats for the years 2010,2011&2012 for comparison.

SFH in Vic,OB,Esq,SE&SW, priced between $375K & $775K with a minimum of 2 bedrooms and 2 baths.

2010 mid Jul-end Dec Avg: $562K

2011 Avg: $561K

2012 Ave: $548K

Within the same criteria since 1st of October this year the average price of a SE home in the areas of Gordon Head, Lambrick Park & Mount Doug was $589K.

Leo

House prices in several Canadian cities more than doubled from 2003 to 2006. Canada was in a bubble at that point. However, as I have already pointed out, the government, in late 2006, went ahead with more policy that dramatically blew the bubble even bigger. By 2008, the bubble was much bigger. Then the crash of 08-09 happened, halted again, by more policy that blew the bubble bigger again. The chart uses 2012 as the peak, not 2006.

The chart that I reference deals with national housing bubbles, not local ones. I have not had time to look at Victoria's numbers for the late 80's through the early 90's. Even if what you say is true for one city, it would not refute the overwhelming amount of evidence that the chart shows for 48 different national housing bubbles over 40 years. I do know that Toronto crashed hard in the early 90's. I know of cases where people, who bought houses in the late 80's in Toronto, had to sell two years later and took a full 50% loss.

Mark Carney recently stated that Canada's housing market was 37% overvalued. The chart shows the same thing.

With that chart, what you see is what really happened. It is an accurate historical, comparative collection of data that we, as Canadians, are better off knowing than not.

With that chart, what you see is what really happened. It is an accurate historical, comparative collection of data that we, as Canadians, are better off knowing than not.

The accurate part I will believe when I see the source data for each of the series they are charting. As I've already said, the behaviour of the data raises doubts about its accuracy.

I have not had time to look at Victoria's numbers for the late 80's through the early 90's.

In case you find some time. As far as I know this is the most comprehensive collection of stats for Victoria. Collected over the years mostly directly from the VREB (other stuff in there from the respective sources).

Within the same criteria since 1st of October this year the average price of a SE home in the areas of Gordon Head, Lambrick Park & Mount Doug was $589K.

Beautiful! Shaky economic times going on for several years now and still no price crash--nevermind worrying decline--in my neighbourhood.

Not saying I'm immune to depreciation. Just happy it's taking so damn long to show up!

Happy New Year, all. Cheers!

@info this is from the article with your beloved graph "prices really do go up most of the time, just like your dad and your realtor always say. However, in the long run, prices go up because incomes and rents go up, mostly due to inflation."

prices really do go up most of the time, just like your dad and your realtor always say. However, in the long run, prices go up because incomes and rents go up, mostly due to inflation.

Very good. Now can you draw the logical conclusion - that if prices have greatly outpaced incomes and rents for an extended period, it is almost a certainty that they will go down.

In the case of Victoria, of course, they are already going down, so it's a fact.

I just quoted the article, which said they always go up...

as will rents and other costs...

"Prices can come down in the western communities but that will never happen here" -Victoria

"Prices can come down on the island by that will never happen here" - Vancouver

"Victoria's prices will drop significantly in the near future."

—innumerable commenters on this blog, going back to 2007

If places like this actually sold, we would see prices decline significantly. Instead they languish on the market for months after numerous price drops.

Listed: $509,000

Assessed: $611,000

http://www.realtor.ca/propertyDetails.aspx?propertyId=12259487&PidKey=-905420131

6 months ago I would have agreed that there were some areas in Greater Victoria that had not been effected by the change in market conditions. And perhaps, Introvert, did live in one of those few neighborhoods.

But that isn't true today. There isn't a neighborhood in all of Greater Victoria that has not experienced a loss in value and longer listing times.

As for a "crash", I suppose Introvert would first have to explain what she means by crash. As there are various definitions of a crash. For some, the market may have already met their definition in terms of peak prices, months of inventory or even market exposure.

On the other end of the market watchers spectrum, the definition of a crash may be so limited that only a nuclear winter could meet their definition of a crash in the marketplace.

Well semantics are allways at play but if we look at the definition "Adjective

Done rapidly or urgently and involving a concentrated effort: "a crash diet". Then by definition we have already moved past "crash"...

And into "slowing down" about a year ago.

Happy New Year to all HHV bloggers from sunny (but colder now than normal) AZ. May the new year bring you all happiness and good time with love ones, wherever you are, renters or owners :-)

Cheers!

Hey Koozdra:

http://www.realtor.ca/propertyDetails.aspx?propertyId=12259487&PidKey=-905420131

Don't know why it's not selling when it's got that lounger toilet feature. Never seen a bathroom like that before. Oh yeah - on New Year's eve it really has extra appeal. Honestly can't believe a realtor wouldn't fix that photo.

Happy New Year everyone!

Tuesday January 1, 2013 11:20am:

December December

2012 2011

Net Unconditional Sales: 283 339

New Listings: 405 505

Active Listings: 3,896 3,780

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

Sounds like a threat.

"This wheel chair friendly home could be your last."

http://www.realtor.ca/propertyDetails.aspx?propertyId=12146598&PidKey=-605628229

Seems like some people on this blog could use some sensitivity training. Just because Victoria has expensive real estate and many could not afford it, that does not excuse the bitterness and prejudices in some posts.

Happy New Year!

Seems like some people on this blog could use some sensitivity training. Just because Victoria has expensive real estate and many could not afford it, that does not excuse the bitterness and prejudices in some posts.

Have you read other blogs? Comparatively, this blog is like having tea and crumpets at Buckingham Palace.

I don't see why first time home buyers/renters would be bitter? With low interest rates and declining prices, the marketplace is certainly favoring them.

If you're a first time buyer, you should determine what type of home fits your needs and what is a comfortable price to pay. If your expectations are reasonable, you may only have to wait a few months before the price and the home that meets these parameters comes along.

Because, for the first time in almost a decade, a buyer can just say no to the Vendor's counter offer knowing that a better home or a better priced home will be coming up for sale. The fear of never being able to own a home is steadily disappearing.

And yes, as a multiple of income, homes are still expensive in Victoria. But it's also true, that many times in the past, starter home prices in Victoria have dropped below three times gross income before stabilizing. And that's with a higher volume of sales occurring than is happening now.

There will be future profitable real estate deals. But these will be development properties where one will have to create wealth by improving the property - not by simply holding the property. That alone will cut out lots of passive speculator/investors in the real estate market.

Of course, this being the year of the snake, we should also see our fair share of less than honorable real estate transactions too.

Have you read other blogs? Comparatively, this blog is like having tea and crumpets at Buckingham Palace.

Haha true. That should go as the blog's tagline.

@koozdra Good find that listing. Too funny. Looking for a pleasant place to mold away your final days? Well look no further than this isolated shack where even the roof qualifies for a seniors discount! Enjoy countryside activities like listening for the roar of the 5:30 plane to Vancouver as it buzzes your house.

One could expertly debate prices, listings, locations and other such factors, then graph months of inventory, sales ratios, trends, rolling averages, then debate some more until blue in the face.

In my own opinion, there is nothing funny about wheelchairs, wheelchair friendly homes or molding away one's final days.

Yup, sensitivity training; quod erat demonstrandum.

Is that some sort of sensitivity curse?

Even tea and crumpets is too risqué for some.

Wonder if the active listings given by VREB will be higher than the final 3896. That is already 13.8 months of inventory. The spring market will be interesting. Last year we got down to 7.5 MOI in March.

The 2013 BC Assessments are now available online:http://evaluebc.bcassessment.ca/. My Saanich West SFH dropped by $20K, making the total drop of $50K over the past two years equal to a 10% reduction.

I feel badly for a few neighbours who purchased in the past few years and now have negative equity in their homes...

My OB home that we rent also just dropped 20K. Remember, these values are an estimate for the value of the home last July.

My condo just dropped 9.4%

My assessment is $10k lower than last year's. A 1.83% decrease.

Assessment drops seem to depend on where you live. After entering in a half dozen properties (family, friends, etc.) around Greater Victoria - the drops seem to range from about 2% to 12%. Condos have dropped more than SFH and Saanich West and Victoria have dropped more that Saanich East and Oak Bay. Can anyone comment on Langford or Sooke?

Assessment drops are something that the consumer market will likely react to. It was front page news in the Times Colonist this morning.

For the average person in Victoria who does not follow real estate this is more of a benchmark than the daily statistical data.

I expect Oak Bay will be impacted in the Spring Market. I'd be surprised if we did not see downward movement.

"According to B.C. Assessment’s examples of standard single-family homes, the largest decrease in the region was in Sooke at 7.4 per cent, followed by 6.95 per cent in rural areas of Victoria, such as East Sooke, Port Renfrew, and Otter Point. The city of Victoria showed the least amount of change, dropping by just 0.9 per cent, while Esquimalt only slipped by 1.5 per cent. This data represents a standard house and is not an average of home values in a particular area, the agency said."

http://www.timescolonist.com/news/local/new-year-assessments-reveal-value-of-most-capital-region-homes-has-dropped-1.38031

My Victoria house is down by 5.1% y-o-y and is also now assessed at slightly lower then when I purchased in late 2008.

I've had to appeal the assessment twice (both successful) since buying as they kept bumping it up for bogus reasons.

Won't be appealing this time around as I think that the 5.1% is probably representative of last summer and is very similar to neighbours changes.

House on Middowne sells for $106K below 2013 assessment ($596K sale price).

Needed cleaning and some paint, but is a solid house, with over 3000 sq ft of potential space, on the slope with views of the mountains. A new benchmark?

Canada's housing bubble will make a full correction this time. There will be no massive, emergency intervention to stop it like the one we saw during the crash of 08-09.

Price and income are tightly linked together when it comes to any housing market in the world. Housing bubbles happen when house prices grow too fast in relation to incomes. This happens when lax lending standards are made policy. Lax lending standards provide excess credit which allows house prices to rise too fast in relation to incomes. This results in a housing bubble where prices are no longer supported by incomes.

This chart shows what happens when house prices rise too fast. It shows this using 48 housing bubbles from different countries over the past 40 years. Note that these are national housing bubbles. That means that the chart deals with at least a thousand different cities.

The housing bubble that developed in Norway in 1978 had its own unique set of lax lending standards that allowed house prices to rise too fast in comprison to incomes. Their bubble burst and house prices went back to the point where they were once again supported by incomes.

The same thing happened in the US in 2005. Again, they had their own set of lax lending standards that caused house prices to rise too fast in comparison to incomes. They experienced a correction that brought prices down to the point where they were supported by incomes.

The same thing happened in Great Britain in 1989. Again, they had their own unique set of lax lending standards.

The same thing has happened in Canada. We had our own set of lax lending standards that pushed prices into bubble territory. Incomes no longer support house prices in Canada. We will experience a correction that will bring house prices down to the point where they are once again supported by incomes.

a simple man

Can you find the 2012 assessment for the house on Middown? Then we can find out how much below peak assessment it sold.

It sold for 15% below 2013 assessment.

It actually went up, as reported by the listing the 2012 assessment was $684K and BC assessment shows for 2013 it is $702K.

Relative to past sale values, the end of 2012 has seen some fire sale prices.

A second floor micro condo in the Mosaic selling for less than what is was previously bought for in March 2006.

A townhouse in Langford purchased back in April 2005 for $235,000. And sold again for just $15,000 more.

A Bear Mountain home along Danby selling for $85,000 less than it was purchased in October 2007.

I can understand why, people are buying. Having been de-sensitized to high prices for so long, these recent sales look great.

And since money is cheap, how low can prices go? A typical middle income household may have a mortgage payment of $2,500 a month.

Could lower prices drop that to $1,500 a month?

And if that happens - what will that do to the rental market?

Most of the rhetoric on this blog says that this is unlikely. However, we are dealing with a marketplace that has been heavily in favor of sellers and out of sync with historic economic benchmarks. Why couldn't the market also shift to the extreme in a buyers market too?

It's nice to think that there is some kind of intrinsic real estate value that sets the low end for prices. But, really there isn't one.

Most of us would leap at the chance to buy Oak Bay waterfront for under a million dollars today. Because we are conditioned to past prices. However, if Oak Bay waterfront was down to $750,000 - why would you offer a million!

If there was some magical formula that would show me the lowest price for a property, I would like to know what it is - and I think the banks would like to know what it is too!

More of a case of assessments gone wrong...2300 Middowne has proximity to Camosun and UVic other than that I don't see 700k by a long shot...My assessment for my SFH in Vicwest is 340k. Case in point, they can be off by a lot...put 1116 CATHERINE (not my house) into evaluebc and compare by sold properties. You will see the wild swings in assessment and sale prices - both directions. They are just not accurate at all...

I just checked e-value for the assessed value on a family property on Saturna Island. It is unchanged!!!! That island has seen almost nothing sell for a couple years now. It is much deader than Victoria.

go figure...

The slope always fetches more money - and that is reflected in the assessments. One or two years ago this house would have easily sold for over $700K.

I doubt it...maybe JJ knows what it last sold for. I don't have such super powers...

The house on Middowne looked better on paper than in reality. It had no garage, just an open "storage area" beneath an added on master bedroom. It will need a major reno to bring it up to anything like the BC assessment valuation.

Assessments in north O.B. have gone up, which seems nuts. The house next door sold last summer for more than $100K below assessment and a house round the corner went early last fall for 20% below assessment, so how come my hardly pristine bung. has increased in assessed value by 20 or 30 K? I doubt I could get more than 85% of the current assessment if I wanted a sale within 6 weeks.

plus the "view" is a stretch and you can't really walk anywhere of interest... Almost 600k for this place is certainly not a sign of some sort of new low...

CS - I am in North OB as well and the house I am in went down $20K from last yr. Interesting.

Many houses on Larkdowne that had a lot of problems sold in the $700Ks as recent as 2011.

Post a Comment