| June 2013 | June2012 | ||||

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Uncond. Sales | 173 |

637

| |||

| New Listings | 418 |

1449

| |||

| Active Listings | 4809 |

5189

| |||

| Sales to New Listings |

41%

|

44%

| |||

| Sales Projection | 692 | ||||

| Months of Inventory |

8.1

| ||||

Beginning of month sales predictor says to expect 606 sales. Pretty much a repeat of last year as it has been for a while. July 2012 is when the mortgage change bombshell hit and tanked the market for the next 8 months. Will we get a similar hit this year?

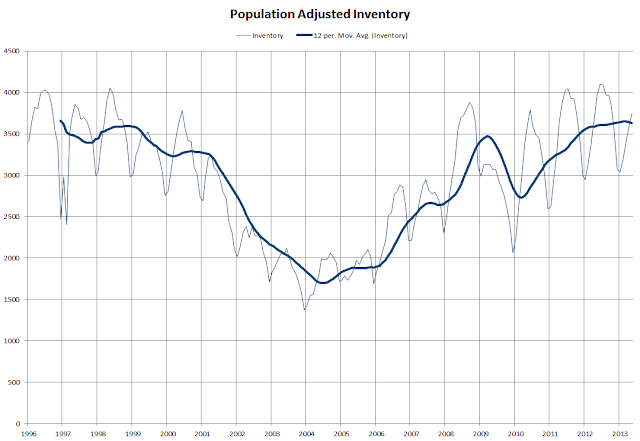

Also, just how slow is this market? We know sales are near decade lows, but how does it compare to the 90s? Thanks to a simple man for providing the population data which allows us to adjust for the growth of Greater Victoria...

While sales are the lowest relative to population that we've ever seen. New listings are about middle of the road. Expect them to continue to decline.

193 comments:

Great graphs, Leo. I always thought that comparison to previous years without considering that the population was expanding concomitantly was hiding the truth.

Thanks for your work.

Leo

Great charts as usual. You are really providing good info to folks here, regardless if they are bulls, bears or halibuts

Beautiful graph porn.

The take home comment that sales have never been lower, when adjusted for population, bears repeating.

Sales have never been lower.

Sales have never been lower.

Yes, good info, as usual.

It's interesting that although at the top end prices are being chopped by multi-millions, houses at the bottom end are selling overnight in some cases.

For example, 1225 Hampshire, listed on Thursday for $699K, sold on Saturday for $715K, just slightly under assessment.

Do the 1% know something the rest of us don't?

I think 1225 Hampshire was an exception. Few houses sell that fast in OB. Even so, it was still $42K below assessment and a very nice home that was very well located.

But yes, many with the big cash know that this could all fall hard very soon (cue Introvert) and are getting out while they can.

Nice graphs Leo. Thanks

I’ll take a WAG at your previous yield query.

“Anyone have examples where our economies diverged like that? What happened to bond yields?”

I figure the 1980s provide a fair model, if you more or less think of the 10% yield line then, as the 0% yield line now. So a 1% move back then, equates to more of a 0.1% move now. US was in full recovery by ‘83, yields were rising. 5yr up a few% by 84, before began dropping again. Greenback strengthened. CAD weakened. Ontario recovered quickest (manufacturing). West and resources stagnated. Ontario (US) will dictate rising/falling interest rates (yields) again. The one thing that could hurt more this time than the 80s for W Canada, is the 2nd largest economy was still booming in the 80s (Japan) which helped provide a floor for resources. This time the 2nd largest (China) is weakening as they’ve already built enough empty cities and have the same demographic issues we have.

Also keep in mind, Japan’s experiment as you called it, is also in effect exporting some of their deflationary problem to the rest of us. Beggar thy neighbour policy. But like you said, it’s tough to determine how other countries respond.

If my model does turn out to have any legs, yields don’t rise significantly until closer 2020 (like 1990).

Disclaimer: I’m as clueless as the next ;)

Thanks for that link, CS.

The Villa Madrona one for $6.9M (originally listed 18.5M), has some funny quotes in its 2006 realtor article. For instance "These sort of properties take time to sell,"

"With the children getting older, we just need a bigger place,"

http://www.canada.com/story_print.html?id=8344388e-4378-4e5f-a0f6-acb6eb8d45e0&sponsor=

Neither inflation nor deflation will be necessary to take down Canada's housing bubble.

But it's always interesting to note what happened in the past.

A period of high inflation in Canada would crush housing prices the way it did in the 80s.

We must keep in mind that the official numbers for any housing market correction always look much better than the reality faced by people on the front lines - specifically sellers. In 2008-2009, many sellers in Edmonton and Calgary had to take losses of 50% or more on recently built townhouses and condos and up to 33% on houses. The official price drop in Edmonton was 15-20% while Calgary experienced a drop of about 20%

In Toronto in the early 90s, the official price drop for that city was about 25%. However, there were plenty of sellers who sold for 50% less than what they had recently paid for their houses.

Recently in Seattle, many houses sold for at least 62% below peak value. The official price decline for that city was about 33%.

The list goes on.

The housing crash in the 80s in Canada was much worse than what most people think. If you are looking at price charts from that time, you do not have the tools to understand or appreciate how devastating the crash was.

The current housing bubble in Canada is, by far, the biggest that Canada has experienced to date. It is, arguably, one of the biggest in the history of the world.

A period of high inflation would cause interest rates to skyrocket and would bring housing prices in Canada down fast. Things would play out much the same way they did in the 80s. Sellers would be forced to sell at huge losses the same way sellers in the 80s had to. Canada cannot inflate its way out of this debt problem. This debt problem took 30 years to form and will take more than a couple of years to correct.

A period of severe deflation would also crush house prices. Japan is a good example of this. Their housing market crashed despite emergency level interest rates.

If the US recovery continues, while Canada's market declines, I wonder what will happen. Anyone have examples where our economies diverged like that?

Keep in mind that BC is not Canada. A US recovery might be good for Ontario and Quebec (automaking, etc.) but not be of much help to the West (lower oil & gas prices due to increasing US production, lower commodity prices due to China slowdown).

So Canada as a whole might not diverge from the US but the West may.

Hi, my name's info. I demand that:

"A period of high inflation in Canada would crush housing prices..." gosh darn it!

Except that the period of highest inflation any of us have ever witnessed (1972-1981) saw the average Victoria SFH go from 25K to 125K+. That's what I would call quintupling, quite the opposite of prices getting "crush"ed.

CPI inflation '66-'04

"With the children getting older, we just need a bigger place,"

The owner is a humorist?

We haven't had many buyers in to see it. But we also haven't had anyone question the price. If they like it, they'll buy it."

Absolutely. But I just didn't like it.

Re: Inflation

The relationships among incomes, house prices, inflation and interest rates are complex.

When house prices are low relative to incomes, as in the early 70's, RE is a credible hedge against inflation and is affordable despite relatively high and rising interest rates.

However, in the early 80's, rapid inflation was curbed by a massive interest rate spike, courtesy of Paul Volcker, that caused a sharp reduction in RE affordability and an RE price crash.

Today, house prices are at the margin of affordability for most first-time buyers, thus a sharp rise in inflation, if promptly followed by an increase in interest rates, would drive RE down.

However, cheap money and inflation go together as cause and effect. Thus, in the early stages of any new inflation, interest rates will remain low, otherwise there could be no inflation.

Only when the politicians panic and interest rates are raised through central bank action will inflation "crush housing prices."

I've been looking a rentals on craigslist in the last few days and came across this -> http://victoria.en.craigslist.ca/apa/3862607042.html

Not a bad deal for a $1.2 million home. I know of a house purchased last year near Camosun in the mid 400s by a family friend renting for $2,400 per month.

^^I wonder if that home for rent never sold? It seems odd that someone would have bought a brand new house to rent.

Shows as sold....

$450,000 seems like a modest place to be fetching $2400 rent. I'm sure your friends have found a place they like, but their landlord should know to be nice to them!

That price is about 16x annual rent. Our current rental place is now asking 24x, our new rental was asking 30x when it was for sale, and the one you found is 36x. Quite the range!

Oh wait, your friend is the owner who is collecting $2400! Good for them!

This one has been craigslist for at least 3 months.

3791039396

The problem isn't that the price is too high, it's that the right tenant hasn't come along.

That sounds so familiar.

At the start of the year, some of the regulars on this blog made predictions about where they thought Victoria house prices would be by the end of 2013. If you did, how does that prediction look so far?

At the end of April, the Teranet index was at 134.84.

"Except that the period of highest inflation any of us have ever witnessed (1972-1981) saw the average Victoria SFH go from 25K to 125K+. That's what I would call quintupling, quite the opposite of prices getting "crush"ed."

You conventiently left out the most important information. House prices in every Canadian city reached bubble territory and peaked by 1981. Shortly after that, housing prices crashed across Canada.

Interest rates skyrocketed as a result of extreme inflation. Skyrocketing interest rates played a major role in the housing market crash that devastated Canadians from coast to coast.

Canada will not experience a period of high inflation. If anything, we will see deflation. There is no reason to continue talking about this.

Housing investment as a share of GDP in Canada is over 7%, which is extremely high. Only twice has this number climbed over 7% and both times Canada's housing market crashed within 2 years (see chart).

Quoting George Athanassakos:

"We have experienced bubbles and busts before in Canada, it’s nothing new. I don’t know why this time would be different."

Canada has recently experienced, by far, the biggest real estate price run-up in its history. This housing market correction/crash will be the most severe in Canadian history.

info - like the links, keep them coming. But this one is from feb 2012.

At the start of the year, some of the regulars on this blog made predictions about where they thought Victoria house prices would be by the end of 2013. If you did, how does that prediction look so far?

Well the current six month average is still well above what I predicted (556K), but then the year isn't halfway over yet. BoC rate is still at 1%. Sales may be running under the rate I predicted and MOI is lower.

Looking over what other people predicted as well I'd say that those who were courageous enough to make a prediction on average erred by being too pessimistic. That said the year is far from being over, so it is a bit soon to write off any of the predictions..

no reason to continue talking about this.

Equals "My simplistic postings were challenged, lets move on"

Average will drop as the year goes on. I said 6 month average at 565 which I think we might still hit, but that measure has been very sticky. I also expected more sales which have yet to materialize. However the last 6 months of the year will be the deciding ones here because unless we get new mortgage restrictions sales should outperform last year by August

I found the graphs adjusted for population to very interesting. One thing that adjusting for population might well hide, is that as the population of the Victoria area increases, it is possible that the market might well segment with some types of properties doing well and some not so well. In particular, it might be interesting to see graphs that break out numbers for houses and condos and for inner city areas (roughly south of Mackenzie) and outer suburbs. I am not sure these graphs would show any differences, but it would be interesting so see anyway.

"Equals "My simplistic postings were challenged, lets move on""

What I wrote simply concluded the conversation. Nothing can refute my logical presentation of factual information.

There will be no period of high inflation in Canada.

The Canadian housing market crashed in the 80s. Period.

There is nothing about the 80s example that suggests that Canada's housing market will not crash this time.

"info - like the links, keep them coming. But this one is from feb 2012."

But highly relevant to the state of the Canadian housing market today. Note that real estate investment as a percent of GDP is currently over 7%. This link will be relevant for years to come.

@ Leo

What was your prediction for the Teranet index?

"I also expected more sales which have yet to materialize. However the last 6 months of the year will be the deciding ones here because unless we get new mortgage restrictions sales should outperform last year by August"

How can you tell the guy recently bought a house?

Nothing can refute my logical presentation of factual information.

There will be no period of high inflation in Canada.

I'll let you think about that for a while.

How can you tell the guy recently bought a house?

See the difference is that I can think logically about the market regardless of whether I own or not.

Last year we had a big sales drop because of the mortgage changes. This year, unless we get more mortgage changes, would not have that effect. Logical, no?

Nothing can refute my logical presentation of factual information.

LOL!

What was your prediction for the Teranet index?

Teranet June 2013: 135

Teranet Dec 2013: 129

"Nothing can refute my logical presentation of factual information."

"There will be no period of high inflation in Canada."

"I'll let you think about that for a while."

What parts of the following two statements are not factual?

"House prices in every Canadian city reached bubble territory and peaked by 1981. Shortly after that, housing prices crashed across Canada."

"Interest rates skyrocketed as a result of extreme inflation. Skyrocketing interest rates played a major role in the housing market crash that devastated Canadians from coast to coast."

@info What was your prediction for the Teranet index?

By the way, as I recall you were the only one that chickened out of making a prediction. Given that no one can refute your logical and factual information, one would expect you'd have no problem offering a prediction.

"There will be no period of high inflation in Canada."

^^ Not a factual statement.

Do damage deposits create a moral hazard?

If I pay my half months rent does that take me off the hook for any damage I do to my rental?

Also, what's the deal with year leases. I guess they are advantageous to the landlord in that they don't have to find a new renter. But what's the difference? the only thing you'll lose is the aforementioned damage deposit.

So I guess what I'm saying is that if you are moving out early and your landlord doesn't give you back the damage deposit, feel free to leave them a dump in the middle of the living room.

"Last year we had a big sales drop because of the mortgage changes. This year, unless we get more mortgage changes, would not have that effect. Logical, no?"

Possibly, however there are many other factors that will come into play.

As housing prics in Victoria continue to sink many potential buyers will put off plans to buy. The psychological factor plays a big role in the inflation of a housing bubble and also in the deflation of a housing bubble. People act on emotion. Fear and greed are powerful forces in any market.

As prices continue to sink, many mortgage holders who bought near the peak will be unable to sell unless they bring a big cheque to the bank or go bankrupt. This will limit the number of sales.

The economy always weakens as housing prices decline. This also has a negative impact on the number of sales. Victoria's economy is struggling and many young people are moving away in search of greener pastures elsewhere.

5-year fixed mortgage rates are rising and may very well continue to do so. This would cause a decrease in the number of sales.

The list goes on.

"There will be no period of high inflation in Canada."

^^ Not a factual statement.

What parts of the following two statements are not factual?

"House prices in every Canadian city reached bubble territory and peaked by 1981. Shortly after that, housing prices crashed across Canada."

"Interest rates skyrocketed as a result of extreme inflation. Skyrocketing interest rates played a major role in the housing market crash that devastated Canadians from coast to coast."

Those were factual statements.

My prediction is that there will be no hyperinflation in Canada.

Communication through text can be confusing.

"Do damage deposits create a moral hazard?

If I pay my half months rent does that take me off the hook for any damage I do to my rental?

Also, what's the deal with year leases. I guess they are advantageous to the landlord in that they don't have to find a new renter. But what's the difference? the only thing you'll lose is the aforementioned damage deposit.

So I guess what I'm saying is that if you are moving out early and your landlord doesn't give you back the damage deposit, feel free to leave them a dump in the middle of the living room."

You might want to do a little research on that through the res ten branch. Hint: you are just flat out wrong on liabilities for breaking a lease, how damage deposits work, and consequences for damage to a suite.

We put a kitchen and a bathroom in our garage. Seven hundred dollars please.

3864441374

"Hint: you are just flat out wrong on liabilities for breaking a lease"

Help me out Totoro. I can't find the consequences of breaking a lease.

"By the way, as I recall you were the only one that chickened out of making a prediction. Given that no one can refute your logical and factual information, one would expect you'd have no problem offering a prediction."

I made predictions, look again.

"See the difference is that I can think logically about the market regardless of whether I own or not."

I mentioned to you several times over the last year that you had your mind made up as to how much of a correction would happen in Victoria and that you refused to look at any information that was different than your own graphs, etc.

You wrote last summer that you would be buying within a year, and you did.

You can't think logically about the market when you are closed minded about the subject.

You knew you would be buying at any time over the past year and your view of the market was the same before you bought as it is now. Why would it change right after you bought? Your view of the market was what made you buy in the first place.

@info’s factual statement:

"Interest rates skyrocketed as a result of extreme inflation. Skyrocketing interest rates played a major role in the housing market crash that devastated Canadians from coast to coast."

Info, if you look at this Gov. of Canada graph of interest rates & inflation, would it not be somewhat more accurate to say the following?

“Real interest rates skyrocketed as a result of nose-diving (or other colouful adjective) inflation. Rising nominal interest rates also played a role in fuelling the skyrocketing real.

I’m not saying my edited statement is any more factual than yours. You are correct that rocketing nominal rates played a large role in the correction, but there were other factors too. If nothing else maybe we could agree that was one kicka$$ drop off in inflation early 80s (15% to 3% !)

@CS, RE: Inflation

Well said!

If you break a lease you are responsible for payments until the end of the lease term.

The landlord has an obligation to re-advertise. You pay the advertising costs if any. If a replacement is found you are off the hook - otherwise you are not.

A landlord can obtain an order to pay against you which can be enforced by the courts and you will need to pay the costs of enforcement.

Your damage deposit is held until the end of the term. It is not used to satisfy damages unless the landlord has your consent or a res ten order.

"Do damage deposits create a moral hazard?

If I pay my half months rent does that take me off the hook for any damage I do to my rental?

No. The damage deposit is your money, and if you damage the unit, the landlord gets to keep it. That's being on the hook, not off.

If you think about it, it's lack of a damage deposit that would create a moral hazard.

@Totoro

You're right. Thanks.

Breaking your lease

If anyone else is interested...

"Another thing you might want to consider is subletting at a higher rental rate. I know of one fellow in Vancouver who has several sublets on the go. He makes a couple of g's a month being the middleman in the high end condo rental business!"

If only our rental market wasn't so crappy this could actually work.

http://apartmentguide.ca/advice/expert-advice.asp?q=698&sub=163

Subletting requires landlord consent. It is a standard term in lease.

I made predictions, look again.

I can't find them in the prediction thread

I mentioned to you several times over the last year that you had your mind made up as to how much of a correction would happen in Victoria and that you refused to look at any information that was different than your own graphs, etc.

I look at everything. We just come to different conclusions.

You knew you would be buying at any time over the past year and your view of the market was the same before you bought as it is now. Why would it change right after you bought?

You're the one that implied my forecast was based on me owning a house.

"Subletting requires landlord consent. It is a standard term in lease."

From my reading on the subject not only do you not require the consent of the landlord, but the landlord has to show that they are trying to rent out the property at fair market value to mitigate their losses. If they don't, they could forego a settlement in their favour.

Driving home on Burnside just now, a real estate sign advertised on the header "no money down" in big red font.

No money, no problem. Sounds familiar.

I was not speaking about breaking a lease, I was speaking about your comment related to subletting at a profit. If you want to leave early in your lease you can request that the landlord advertise to rerent. You do not get to sublet without their permission.

"You do not get to sublet without their permission."

Right. You need to find a seriously absentee landlord. They'll never know. A good conman can make a lot of money in a good rental market. Not ours, but a good one.

"$10,000 cash-back for accepted, unconditional offer by July 15, 2013"

OMG, a time limited offer. Quick get the checkbook. I would like to place my unconditional offer on this insanely priced property. I HATE conditions.

13136096

just curious, have any landlords here been able to collect on a broken lease? I've heard it's difficult.

I always thought that it was automatically one months rent as penalty, but actually it is just provable damages. Getting a tenant to pay for the rent for the remainder of the term, good luck with that.

Finding a rental no easy task....half the people aren't even replying. One replied with "Sorry, just rented it a minute ago."

Odd. Last fall we had people practically begging us to rent places. Maybe different market segment.

Sure are a lot of 'month free', 'move in bonus' rental ads. I would think that is a sign of weak rental market...

I've had no problem renting.

As for collecting the remainder of a lease term, pretty easy as long as someone is employed and/or has assets (ie. a car).

A res ten order for payment can be enforced by the courts. Costs of enforcement are passed on to the tenant. You just need to follow through.

Where you would have trouble collecting is where someone is broke. Of course court orders are good for seven years and can be renewed.

>> As for collecting the remainder of a lease term, pretty easy as long as someone is employed and/or has assets (ie. a car).

That's not the hard part. You can only collect actual provable damages. So advertising costs (zero these days) and lost rent. But if you're going to try to claim lost rent for the remainder of the term you're going to have a hard time proving that what you were trying to rent it for was market rent. You can't just leave the unit empty and then automatically claim the rent from the previous tenants.

Why would you approach it this way - it makes no sense. The landlord does not have to prove they are renting at market - no obligation at all if the lease was for that amount that is what they are entitled to.

A landlord has an obligation to advertise. They do not need to advertise for less than the price it was previously rented for. If it does not rent in time they can offer to the tenant to advertise it at a reduced rate. The tenant is responsible for the difference between the lease price and the new price if they agree. If the tenant does not agree to the reduction the suite is then posted at the same rate.

When it comes to proving damages the landlord will demonstrate this by presenting the correspondence, the ads posted, and the replies received and outcomes of the replies. This is all that is required.

I think the most important thing you can do as a landlord is offer a quality product and screen meticulously and always trust your gut.

Yes, although this does not prevent someone from getting into a relationship, or buying a house, or being transferred. If you are a landlord and use leases you should expect to deal with this scenario and be prepared.

There will be no period of high inflation in Canada.

Depends what you mean by inflation.

Canada has seen a massive expansion in credit over the last decade, which means inflation of the money supply, notwithstanding that the rate of increase in the CPI has been low. However, there has been massive increase in RE prices. So have we been through an inflationary period or not?

The answer is that we are in, or toward the end of, a period of rapid monetary inflation, which has driven the price of RE to an extreme, while global wage arbitrage, computerization and robotization have had a powerful deflationary effect on prices of many goods and services.

The monetary inflation has been driven by central bank policy to counter the forces of supply-side deflation.

But monetary stimulus loses force as interest rates approach zero. Other than paying people to borrow, there's nothing more the central bank can do.

The Federal Government can continue the stimulus by printing and spending, but the present government seems intent on something approaching austerity. Likewise, the new government in Victoria, which is promising a balanced budget this fiscal year.

Thus there now seems to be nothing to propel RE upward, which means that the current downward trajectory in RE will continue.

A consequence of the global deflationary trend is that employment income will tend to fall, which will put a squeeze on how much families can allocated to RE.

"The housing market has been building very steadily over a period based on growth, jobs, good income, and a Canadian economy that’s been in good shape."

No mention of the extreme credit expansion and historically low rates.

INTERVIEW: OECD’s Gurria Doesn’t Equate Hot Housing Market with Bubble

"While prices in Vancouver and Victoria sank, others climbed over the course of the year, according to today’s Teranet-National Bank house price index."

Victoria, the Zoidberg of Canada.

Home prices rise 2%: A crash isn’t forecast, but neither are big gains

Teranet shows another -0.8% for Vic last month.

I think employment falling -1.6K Apr to May is partly why rental vacancies are rising.

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/lfss03l-eng.htm

Yes, although this does not prevent someone from getting into a relationship, or buying a house, or being transferred. If you are a landlord and use leases you should expect to deal with this scenario and be prepared.

I like month-to-month. That's what I do.

The point is that it is extremely unlikely you will be on the hook for remaining rent if you break your lease. A landlord claiming that would have a very hard time proving they had no way to rent the unit at all (as opposed to at a reduced rate, so you might be paying a few bucks a month difference)

Leases are better if:

1. You only want to rent for a specified time period and want to make sure they will move out on a date specified.

2. You live out of town and don't want the hassle of re-renting.

3. Places are more difficult to rent except for at, say, September 1 (vic is not like this) due to market conditions ie. students/temporary work projects.

A one hundred dollar reduction in rent over ten months adds up. This can and does occur.

Leases are predatory and only benefit the landlord. There is absolutely no gain for the renter.

You may be legally obligated as a renter to pay the difference.

Just don't do it.

Let the landlord send it to a collections agency, court or what ever.

Better the food is on your table than theirs.

Vacancy and bad debts thats just part of doing bussiness as a landlord.

You may be legally obligated as a renter to pay the difference.

Just don't do it.

Let the landlord send it to a collections agency, court or what ever.

Better the food is on your table than theirs.

Vacancy and bad debts thats just part of doing bussiness as a landlord.

You can't be serious? If you give your word(let along sign something) you need to live up to it.

"I made predictions, look again."

"I can't find them in the prediction thread"

I'll find them.

>> There is absolutely no gain for the renter.

Not really. As a renter a lease can also protect you in the same way. If the landlord wants to kick you they can't as easily.

RE: Teranet,

Back to July-07 prices and 9.1% below Aug-10 peak.

"Not really. As a renter a lease can also protect you in the same way. If the landlord wants to kick you they can't as easily."

Right, but I would argue that leases disproportionately favour the landlord as renters moving between properties should be a more common occurrence than a landlord evicting based on selling the place.

Perhaps not in Canada's amateur rental haven.

The May Teranet index data for Victoria shows a year-over-year drop of -4.08%.

The May index drop of -0.80% was the fourth consecutive monthly price decrease. Victoria has now recorded 8 price drops in the last 10 months.

Victoria's current index level is the same as the level for July 2007. That puts a lot of mortgage holders under water. Those who felt rich and took out home equity lines of credit while prices were higher... well, let's not get into that.

Leases are mutually beneficial.

Often a landlord offers a place at a discount for a long-term lease because, for example, they may live out of town. This matches the applicant when they plan to stay put for a bit.

A tenant may ask for a lease (I've had that happen twice - one wanted a two-year lease) because they don't want to have to move if a place is sold. The lease is binding on the new owners. A month to month tenancy allows the new owners to evict you if they plan to move in or do substantial renos.

As for bad debts, I don't respect anyone that believes that their rent should be paid by someone else as a "cost of business". If you have hardship and declare bankruptcy that is a reasonable limit to debt. Otherwise, your obligations are yours.

In a world that lacks accountability and responsibility you want the tenant to play fair!

Why?

I constantly read how wonderful it is to be a landlord and how rich the landlord is getting off the tenant. I figure if a landlord wants to gloat about how smart they are - should a renter care if the owner gets shafted once in awhile.

Interesting. I was a renter for a many years too. I never felt that way. I always felt that it was up to me to find value for money and to pay my own way in the world.

I was grateful for renting nice space when I could not afford to buy or when I was going to be somewhere for too short a period of time.

The remedy for dissatisfaction with renting is to save and become an owner yourself. I did this through working full time while in university, not having a car, not eating out, not having cable, and generally not buying stuff.

You'll have to forgive me if I have little patience for people who complain about landlords "getting rich" and that they should be "shafted". In fact, I find that leads to a loss of respect on my part for you.

As for "getting rich", some landlords do over time but they invest their capital and effort into owning and take all the risk of falling markets. They could invest in the stock market instead.

A shortage affordable of rental housing already exists in Victoria because costs of ownership are high and returns relatively low. You need a house with a suite to break even for the most part.

If you want free rent I recommend you find yourself a sugar mama or move back home.

As far as accountable and responsible, why yes, I do expect those qualities in the people I choose to rent to, live with, and associate with.

In any event, there are rules that both landlords and tenants need to follow. Do some research on the res ten website and you'll discover fairness is actually weighted towards a tenant.

Do what is right in this world, even when no-one is watching. I live that way and teach my kids to do so as well.

re leases

as a tenant in the past I preferred to rent month to month for the flexibility, but did sign a lease on occasion when it made sense. I never had occasion to break a lease, but if I had I certainly wouldn't have felt any obligation to pay the remaining term, nor does that obligation exist in law as has been pointed out here.

as a landlord currently I'm not really a big fan of leases either. The only circumstances where I would definitely want a lease (fixed term rental) is if I knew in advance I wanted tenants out by a certain date.

In theory the lease gives the landlord some protection, but in practice would I really go through the effort to get a court order for expenses that are likely to be a few hundred dollars if someone moves out early?

It seems you not only want the rent, but sympathy as well.

Victoria is growing and you're going to get the problems associated with bigger cities too.

Not paying your rent is a bad thing. Bad things happen to nice people.

"In Oak Bay, we will see some house sales for at least 25% below peak price or peak assessment. We will see some condo/townhouse sales for at least 30% below peak."

Info that was your prediction back in Jan. Certainly the part about 25% below peak assessment is likely to come true no matter what the market does since there are always places assessed stupidly. I live in Fairfield and a place near me sold in 2009 for more than 30% below assessed even when most other places were selling near assessment.

A prediction about the market as a whole (averages, medians, whatever) like others made is obviously more useful than a prediction about outliers.

Suppose I predicted that "in December 2013 some houses in Oak Bay will sell above assessment" I might end up being right but it would hardly tell us much about the state of the market.

I believe Caveat Emptor is being more realistic when it comes to the tenant-landlord relationship.

Are you really going to sue a tenant. Not a chance. As a landlord, sometimes you gotta take a hit.

Is signing a year lease going to stop a tenant from renting a place that they know they only want for 10 months. No, they'll just sign.

"but in practice would I really go through the effort to get a court order for expenses that are likely to be a few hundred dollars"

No. You would get them to sign an agreement to reduce the rent owed from their damage deposit. If they refuse you go to res ten. Very easy process done by teleconference from your home.

"It seems you not only want the rent, but sympathy as well."

Nope. I'm very grateful for everything, especially family and health. Rental matters are pretty low on my list of concerns.

I'm certainly not complaining about prices, I don't really care if they go up or down. My plans are not based on what the market does short-term or on high cash flow because it is what it is.

I just dislike the attitude and can only hope it is done to provoke and not because that is where your ethics are.

I don't know how you are going to get them to sign such a document? Do you try to get them to sign when they first rent the home - or when the problem starts.

Like you've said. The residential tenancy act favors the tenant. As a landlord any time you go up against a tenant - the odds are in the tenant's favor. Make the tenant's life difficult and they can report your illegal suite to the city and the CRA.

You can have someone sign a document converting the damage deposit to rent - but they could argue the legality of such a document especially if done under duress.

I mean its great to say that you're right - and you are. But you're not likely to get a dime.

I predicted Teranet to be 133 for June and it's now 133.76 for May.

I think Leo was a bit less bearish and predicted 134 or so, which means his prediction has already been borne out.

For me it's all about the reason someone is terminating the lease early.

If they found a cheaper place and want to move then go after them.

However if someone lost their job or got transferred and a landlord comes after them for the owed rent, that is just pure evil.

Sure seems like Just Jack is trolling.

I'm not going to argue with you about this. The information is available here: http://www.rto.gov.bc.ca/

As far as CRA goes, you need to report this income.

As far as illegal suites go, good opportunity to legalize if you have not done so already.

Make the tenant's life difficult and they can report your illegal suite to the city and the CRA.

In all my years, I have never heard of Saanich (my municipality) busting an illegal suite.

Also, I claim the income on my illegal suite and CRA doesn't care that it's illegal.

I know they can bust suite sin OB, but i do not think they are very aggressive about it. I could bust 50 within 4 square blocks of my place. The nice patio doors on drive down garages always gives it away.

I've heard of Saanich ordering the kitchen stove to be disconnected and that there not be a locking door between the main and lower level.

As for legalizing suites. I feel that a basement suite can be built at the time of the homes original constuction with a permit. Any basement conversions after the date of final occupancy should have the entire home upgraded to current building code standards. Including ceiling sprinklers.

I also think that those with a suite should have a business licence.

I'm risk averse so I declare suite income to CRA. Usually enough legitimate expenses that the net for tax purposes is not that great so the actual tax paid is pretty modest.

Cheap compared to being audited, fined etc.

Any complaints have to be in writing. You just can't squeal on your neigbour over the phone. The city will then act and close the suite down.

None of the people I know, that have suites, declare the income.

True it's minor. But the tenant that squeals to CRA gets paid by them. So maybe you shouldn't argue too much about the damage deposit.

Some suites can't be legalized (easily). Mine lacks sufficient percent of floor space with 7 foot ceilings.

I'm not likely to dig down or raise the house to get two inches height.

Nice place (big windows, private garden, 150 metres to the beach) if you are under six feet, but not rentable to a tall person.

"But the tenant that squeals to CRA gets paid by them."

I heard this only works if the CRA can collect $100,000 or over.

I've seen basement suites with only 5.5 feet of height.

How many years has the suite's income not been declared?

I live in a basement suite for three years during my undergrad here that was at best 6'2" and 5'9" in some places. Had to be careful and duck at the right times. But, it was clean and my landlords upstairs were good people, so I thought I was blessed. Seem to remember rent being $400 monthly for two bedrooms.

No, there is only a 15% reward where CRA collects more than $100 000 of federal taxes owed from INTERNATIONAL tax non-compliance as a result of the report.

None of the people I know, that have suites, declare the income.

Apparently, you hang with some shady people.

As for legalizing suites. I feel that a basement suite can be built at the time of the homes original constuction with a permit. Any basement conversions after the date of final occupancy should have the entire home upgraded to current building code standards. Including ceiling sprinklers.

A new home with a suite does not require ceiling sprinklers as far as I know?

While your idea is great in theory....good luck upgrading an older entire home to current code. Might as well demolish everything.

Three in a row. That could be a new record.

14 million in mortgages on a property they're now trying to dump for a third of that. Another example of how prudent our banks are

^^ I'm sure the view is great, but other than that it doesn't even look like that nice a lot. For that price I'd want a nice chunk of land to go with the house. Not that I will ever be in the market for that kind of excess.

Pretty small target market in Victoria.

64.1% off original ask!

That pulls ahead of Villa Madrona 62.2% off.

14 million in mortgages! Now we all get to pay for the stupidity of the banks, govts, & bulltards. Let's hear it for Canadians. As retarded as they come! Our children will be so proud of the mess we left them.

"But it warns that conditions could come tumbling down like a house of cards if any number of shocks, both in Canada and in the global economy, were to occur."

Duh.

Bank of Canada warns on Toronto condo market

"Markets have been slumping all week since the world's central banks started showing signs they won't be willing to keep the stimulus taps on forever. In late May, Federal Reserve chief Ben Bernanke said the Fed might pull back on its $85 billion-a-month bond-buying program, if economic data improves."

How will the housing recovery in the states look when interest rates start to edge higher.

TSX slumps again amid investor gloom

"Responses could range from cutting the Bank of Canada rate to relaxing regulatory restrictions on housing demand. Housing bears might complain about such measures but they would allow Canada to reposition back to a soft landing."

"The government has my interest at heart" -Canadian homeowner

Canada’s lucky to come late to the housing-crash party

* from VREAA

How much of our market is speculation and how much is appreciation mostly attributable to inflation and the economy.

Look no further than Duncan. Not a heck of a lot of speculation going on there any more.

That's why a home bought in December 1995 for $129,000 sells today for $219,000. A 70 percent appreciation over 18 years. And it has been updated too!

Sounds reasonable to me.

The typical home in Victoria's core was selling for $236,000 back in 1995. House prices were in a recession back then with sales activity some 22 percent less in the core than today.

Today the typical home in the core sells for $585,000 or 147 percent more. So it still seems that there are a few die hards still speculating house prices will once more rise from the ashes.

For me, it still seems that the typical Victoria home buyer is paying $1,000 a month too much for their home. That's a thousand dollars each month that would be better spent in the local economy to support businesses than given to the banks to spend in the Cayman Islands.

Property taxes, utility charges, electricity and water have all risen over 40 percent in the last decade.

We have become a city dependent on Costco, Wallmart and Target to make ends meet. With most people just a paycheque or two away from bankruptcy having tens of thousand of dollars on their credit cards and lines of credit.

tsk, tsk, tsk how the mighty do fall...

Look out below, warning to all readers - the spin is thick

I found this interesting - In May 2013 RBC published their Housing Trends and Affordability Report. Victoria came out as a very close 3nd for most unaffordable market place when comparing mortgages to pretax income.

Specifically:

"the proportion of median pre-tax household income required to service the cost of a mortgage on an existing housing unit at going market prices, including principal and interest, property taxes and utilities; the modified measure"

Victoria was at about 41% - 42% (Standard Two Story and Detached Bugalow)

But that's based on a

* 25% down payment

* 25-year mortgage loan at a five-year fixed rate.

* Pretax income

What about

* 0% down ?

* 40 year amortization ?

* After the CRA takes 25% - 30% ?

As a renter I'm at about 20% (Rent + utilities) with a family income higher than the average (pretax income to compare with the study).

Isn't it obvious that many people cannot afford their mortgages or that they are house poor?

Thoughts?

BTW Vancouver is about 81%, Toronto 41%-50%

REF: http://www.rbc.com/economics/market/pdf/house.pdf (Page 8)

Since the median net worth of Canadian households is more than $150 000 your statement that "most people (in Victoria) are just a paycheque or two away from bankruptcy" is simply false.

Bankruptcy does not occur when your assets exceed your liabilities.

JJ RE: TC - Len Barrie

“It just needed a break. The market was quite soft at that point,” said Scott Piercy

Maybe a "break" in price. It looks like you dropped the price by 5 Million since that "soft" period last year.

Am I misreading this? What is Piercy trying to say? That the market is not soft now?

^^ RE: Totoro

This article says more like $199,700 but..

“Real estate makes up about half of our total assets, not including debt,” said Doug Porter, chief economist at Bank of Montreal.

Lets hope the real estate value holds up - it can also go poof!

http://business.financialpost.com/2013/05/15/do-canadians-love-real-estate-too-much/?__lsa=aa0e-8411

Yes, I only had the stats can figure for 2005 which was $150 000.

RE is part of this but the other three components are pension assets, financial assets, and equity in business.

Even if real estate counts for $100 000 (although principal residences only count as approx. 33% of wealth) of the $200 000 median figure, and there is a 20% decline in real estate all across Canada in one year, you are still at a figure of $160 000 in net worth.

Nowhere near bankruptcy.

http://www.statcan.gc.ca/pub/13f0026m/13f0026m2006001-eng.pdf

Even if real estate counts for $100 000 (although principal residences only count as approx. 33% of wealth) of the $200 000 median figure, and there is a 20% decline in real estate all across Canada in one year, you are still at a figure of $160 000 in net worth.

That is only correct if the RE is unleveraged, which of course it isn't for about 2/3 of homeowners, and a larger proportion where prices are highest.

The US saw a 35% average decline in RE. What did that do to household net worth? Many saw it go negative.

Toronto condo market could destabilize economy, Bank of Canada warns

most people just a paycheque or two away from bankruptcy

That's a bit of hyperbole.

For bankruptcy to happen you generally need:

1) liabilities (debt)

2) no assets to divest

3) cash flow falls short of current expenses plus payments on liabilities

4) no capacity to take on additional liabilities

Absent all four of those you may be vulnerable but you aren't yet a candidate for bankruptcy

Totoro's and Caveat's vision stops at the borders of oak bay and fairfield. There's a whole world out there. I know many people living paycheque to paycheque.

"Assuming that most homeowners do not anticipate this sort of plunge in prices, and have not hedged themselves against this possibility, we may be in for another round of very bad news if interest rates ever return to more normal levels. It is remarkable that the latest run-up in house prices has received so little attention from people in policy positions. There may be an enormous price to pay for the continued lack of attention to housing bubbles."

"Our housing market is different" -Everyone everywhere.

The Reemergence of Housing Bubbles: Should We Be Worried?

Koozdra - i agree - LOTS of people living pay cheque to pay cheque. That's true to some extent even in the exalted lands of Fairfield and South Oak Bay.

And that is a vulnerable position to be in. But not every person living pay cheque to pay cheque is an immediate bankruptcy risk if they lose their job, because ALL those factors have to be in place before bankruptcy happens (and they have to be unable to find another job).

BTW, just because I am relatively speaking financially fortunate, doesn't mean I don't understand that tons of people are struggling.

Actually my pet peeve is couples making combined 250K per year that refer to themselves as "middle class". Since when did 97th percentile = "middle"

"That is only correct if the RE is unleveraged" - yes, you are correct.

If you have a $250 000 mortgage on a $350 000 home you lose $70 000 of your $100 000 of equity and your net worth.

A 35% drop might see some with negative net worth, but not the median family in Canada. The primary residence is only 33% of the median family net worth figure.

In the non-Uplands part of OB, I know a lot of people living paycheque to paycheque, or worse - on their home-secured line of credit.

While I think very few would go bankrupt, many would have to divest their largest asset (house) and repay both the typically $300-$600K mortgage and their substantial line of credit. Another trip to Vegas and then Maui, anyone? I can only shake my head at the number of people here living far beyond their means. if this starts to turn like we think it might, OB will certainly not be immune.

Little bankruptcies, but lots of fire sales and moves to Sooke.

I love how the stats are ignored and Fairfield and OB are pointed out.

It is quite probable that we all know people who live paycheque to paycheque but:

1. This is different than saying most are one paycheque from bankruptcy (ie. you have home equity or RRSPs or a pension but you need your paycheque to cover monthly costs)

2. Even if we talk about living paycheque to paycheque, this is not the majority of people in Victoria or Canada. In fact 70% of Canadians do not live paycheque to paycheque.

http://news.ca.msn.com/local/toronto/1-3-of-canadians-live-paycheque-to-paycheque-survey-suggests-2

We have become a city dependent on Costco, Wallmart and Target to make ends meet. With most people just a paycheque or two away from bankruptcy having tens of thousand of dollars on their credit cards and lines of credit.

We have become a city dependent on Costco, Wallmart and Target to make ends meet. With most people just a paycheque or two away from bankruptcy having tens of thousand of dollars on their credit cards and lines of credit.

"In fact 70% of Canadians do not live paycheque to paycheque."

Gotta love how those online surveys turn into facts...

"However, about 70 per cent of Canadian households reported they had accumulated some wealth.

But Lefebvre said the result may have been more of a "feeling" than an objective assessment of wealth."

If that is not reliable enough here is an ipso reed survey from last September. Not sure what source might be more credible - there may not be one.

http://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/one-third-of-canadian-households-living-paycheque-to-paycheque/article12056287/

As for a feeling of accumulating wealth - odd response. What does that even mean and who can't ballpark their savings?

How crazy can things get.

Just spent some time talking with a builder. Seems he got into some problems a year ago. The home he was building for himself wasn't finished but he talked his friend, a building inspector, into giving him a final occupancy permit. Then he talked another friend, a real estate appraiser, into giving a high value on the unfinished home. Then he got a mortgage with payments of $8,000 a month. Then he didn't make any payments.

Now he wants to renegotiate the mortgage for interest only payments at $2000 a month. Otherwise he will walk away from the unfinished home that is only worth half of the mortgage amount.

Bet the bank takes his offer.

I was sitting in a cafe yesterday and overheard the conversation behind me: "... there is going to be a glut of condos in Toronto. He already sold his house. Have you heard of Garth Turner?..."

Sharp ears, Dimitri.

Yup, I posted to Garth's blog too.

JJ - I hope the building inspector and the appraiser are charged with fraud - they should be.

Hopefully the bank blacklists both.

The builder sounds like a less than honourable man.

Never will either get charged with fraud. Because you either can't sue them (municipal worker) or you can't get damages as E & O insurance does not pay out for fraud. Unless you know a lawyer that will work for free.

As for the builder - that's just business. Why should he not try to get the best he can.

The end result - you'll have to pay another penny for every cheque you write.

Most likely some appraiser had to value Len's Bear Mountain home for $18,000,000 or more to get $14,000,000 in financing.

Do I think the appraiser should be sued - damn right. I think she should be dipped in tar and feathered. But that`s the conservative side in me talking.

Well - if I were the bank manager, I would have a firm word with both the appraiser and the mayor of Langford about their inspector. Banks have lawyers on retainer, so send a few strongly worded letters to rattle their cages. And never, ever use them again. Bank - "ok, so when you send out the inspector we will not accept the word of xyz as he has shown to be not competent". Manager to employees - never hire appraiser xyz ro anyone from xyz appraisers - they lose us money.

I would then immediately tell the builder to pay up or get out. Make an example of him or else the "cheating the system" attitude will spread and ever builder will try that trick.

Marko, how goes the apartment hunt?

For most of the Chartered Banks, you have to go way up the food chain from a local bank manager for that to happen. Bank managers no longer have that authority. What appraiser are hired comes from head office in Toronto and the Appraisal Management Companies such as Centract, Centrum, NAS all of them located in Toronto.

Smaller lenders still choose their own appraisers and will "blacklist" the bad ones. Probably because they care more for their members than the big Chartered Banks or suitcase banks like ING.

It's no surprise that the market went wacky when the local bank manager lost control.

Thanks for the perspective, JJ. It is a sad state of affairs when there is that much money on the line and that little oversight. I guess we taxpayers pick up the slack.

>> I love how the stats are ignored and Fairfield and OB are pointed out.

Indeed it is funny. Usually it is you that likes to ignore the stats and go with the word on the street. I do agree that stats are much more fun when they match your point of view.

Marko, how goes the apartment hunt?

Painful. A lot of people (including some property managers) don't return emails in a timely fashion, some people leave ads up on craigslist long after the unit has rented. One guy emailed back to call him, I called him, left a message and two days later he still hasn't returned my call?

There was a good deal on a one bedroom + den at the Aria @ $1,400 per month but it rented in a matter of hours. I wouldn't mind spending up to $2,000 per month but it would have to be something fairly nice. Also don't mind going across the bridge to Shutters, Bayview, or Dockside but only one unit at Shutters @ $2,200, unit at Bayview rented already, and the one at Dockside a tad too small. And that is it between the three!

Marko - these are people you would not want to rent from anyway, so they just self-selected themselves out of consideration.

I wonder if it's more complicated to delete Craigslist posts or something. I repeatedly saw posts that appeared on Used Victoria, Kijiji, and Craigslist, which would then vanish from only the first two.

That even happened to the place we eventually rented, which was handy, because we could point friends to the ad and say "that's where we're moving."

Be sure to use padmapper.com if you're not already.

This is the $1095 condo I would take right now if my lease was up. The views are spectacular and only two blocks to inner harbour. Low utility costs & underground parking too.

http://victoria.en.craigslist.ca/apa/3849558394.html

2 more available in same building for July 1 (June rent free)

http://victoria.en.craigslist.ca/apa/3849214437.html

http://victoria.en.craigslist.ca/apa/3863968223.html

I think you need to widen your search. Lots of rentals out there, but perhaps not in those new buildings.

I think you need to widen your search. Lots of rentals out there, but perhaps not in those new buildings.

Pretty much searching for any building in the core 2000 or newer. Would consider Reef, Shoal Point, Aria, Astoria, Juliet, Falls, Hudson....etc.

There just isn't a lot out there.

This is the $1095 condo I would take right now if my lease was up. The views are spectacular and only two blocks to inner harbour. Low utility costs & underground parking too.

I've shown a number of units at Roberts House....not what I am looking for.

Some crazy deals on Bear Mountain but don't want to live up there ->

http://victoria.en.craigslist.ca/apa/3864850503.html

Plus I think the value in renting is on the high-end. Seems like approx 200k condos still go for $1,000 per month; whereas, $500,000-$600,000 condos you can find for around $1,700 - $2,000 with a bit of luck. Strata fees and tax on some of them are $600-$700 per month.

"The changes suggest those overseeing CMHC “don’t like what they see,” said George Athanassakos, a finance professor at Western University’s Ivey Business School in London, Ontario. The economic risks of a housing-market decline justify taking “aggressive measures” at CMHC, he said."

Bankers Joining Plumbers on Canada Housing Agency Board

Plus I think the value in renting is on the high-end.

Both on the high end and the low end that doesn't have a comparable in the ownership market. Rents in the 60s dedicated apartment blocks are very affordable. Of course they're not fancy places, but it's a way to live cheap, and far preferable to buying an old condo.

"Bankers joining plumbers"

Great headline. It's funny because it's true.

There are some nice 50's,60's apartments around that are very nice if you look.

I know of one on the corner of government and I think superior. Friends of mine looked at one there, and I looked with them. It was maybe 800 sq ft, top floor with some great views (legislative bldgs, downtown and water glimpses), large bright kitchen, corner unit with big window in the dining room and sliding doors to balcony. The master bedroom could fit a king size bed,+ night tables and triple dresser. It also had a wall to wall, floor to ceiling mirrored closet. The bathroom was nothing to write home about but it was clean and had nice tiles around the tub. The rent was around $1010 per month and parking was only $15 per car. Also, no lease was necessary.

Found this on Reddit posted on /r/vancouver – I wanted to share.

“My attempt at answering why the rent is so damn high!”

http://www.reddit.com/r/vancouver/comments/1gd7jc/my_attempt_at_answering_why_the_rent_is_so_damn/

Upvote delivered.

Since we have a few landlords/tenants on here I thought I would ask the question.....

Why would a tenant ever sign a fixed term lease that ends at the date and the tenant must move out (versus a lease that continues month to month after the lease term)? From my real estate dealings over the last three years I've only ever seen a fixed term lease that ends benefit the seller.

Can't really think of a benefit for the tenant unless I am missing something.

When the rental market was tight, it was fixed term lease, or nothing. I've always negotiated fixed term for first year or six months and then month to month after.

Is this a leasing company or an owner?

Showed up to a place downtown this morning with 7 other potential tenants.....6 took applications. Maybe $100 below market value.

Both houses we've rented from property management companies required a fixed term lease if you wanted to rent.

The first one routinely renewed for another year when the lease was up. That's what the new one says they intend to do too, but we recognize it's a risk.

Marko, tenants sign a fixed term lease when it is the place they want and it aligns with their plans.

I sign fixed term leases every year with tenants from Sept-June. Matches up with student schedules and mine and the place is nice and furnished and easily rented out this way.

With a fixed term lease you trade off the security of not having to move for a set period of time with the certainty that it will have an end date unless removed. Tenants who have been asked to leave when a house has been sold are often happy to fixed term security for this reason.

We manage renal suites for friends, and do only fixed terms, Sept to July, but the tenants could renew for another fixed term, not only if they want to stay, but also IF they can make that decision a few months before and IF WE want them to stay.

I think this is to benefit the owner; 1. to avoid the rental market slow season. 2. to pick up good tenants for next term ahead, eg sign a lease in April or May for Sept start (normally people look that early are more organized and good planner).

By doing this way, we never had any vacancy for 3 suites (1/3/4 bedrooms) for past 3 years. All very good tenants except one (a sublet without our knowing and checking), most are students and most stay two terms, AND we never post our rental, but find good renters via their own rental request posts.

Of course, if you know you may sell the house/apt within a year time, then you should avoid a fixed one year term.

Happy father's day to all the dads!

"...but find good renters via their own rental request posts."

Where do people post these? Craigslist?

Many other scenarios also benefit the landlord.

For example, if you are in a fixed term tenancy with a fixed date of August 31st, 2015 and the owner puts the home on the market in June, 2015 and it sells with a completion of September 1st, 2015 the landlord does not have to give the tenant a month free rent.

If you are in a fixed term tenancy that goes month to month after August 31st, 2015 the owner would have to give the tenant a month free using the same scenario as above. When a lease is the month to month option after the lease term you still need to give the two months notice even if the completion date is a after the lease term date.

Anyway, in conclusion, as a tenant I would always push for lease term that automatically goes month to month after the term is up. Unfortunately, I don't think many tenants understand the difference and probably get suckered into the other option.

Happy Father's Day to all you dads out there - good-on-ya for all the hard work, sleepless nights and personal sacrifices. I don't believe dad's get recognized enough. Cheers mate!

Interesting Articles over the past few days:

Paul Krugman: Canadian Economy Vulnerable To 'Shock' Due To Debt Levels, House Prices

House Prices, U.S. vs. Canada (Chart)

Trump Tower brand coming to Vancouver project

Only under the Trump Band but built by Developer Holborn Group. Apart from his name, it appears the The Donald doesn not have any dollars invested in this RE project.

"the project was originally launched before the global economic meltdown, the 60-storey tower, which will twist 45 degrees as it rises, was to feature a high-end Ritz-Carlton hotel on the lower floors."

Will Reduced Prices bring buyers?

Back in 08 they priced condos at 2300 st ft now they will be closer to 1600 Sq Ft.

There's plenty of that HAM left right?

"We are naturally excited about Vancouver. It is a great city with tremendous access to the Asian market and we look forward to continuing to explore the potential of bringing the Trump flag to this location," - said a statement released by the pair.

Did we miss the HAM boat..?

"Marketing to international buyers was also the plan when the Residences at Hotel Georgia was promoted, but now that that project is built and 60 per cent sold, the majority of buyers turned out to be local."

HAM leaving?

Hong Kong Chinese leaving Vancouver ‘by the thousands’

4 Million Dollar Discount. Not as good as the multi-million dollar deals in Victoria - but you can't beat that view!

Vancouver condo sells for $25M, was one of Canada’s most expensive listings - was listd at 28.8 Million

"Where do people post these? Craigslist?"

Sometimes, but mostly on Kijiji and UsedVictoria

"The Canadian Real Estate Association will release data on Monday about the number of homes that changed hands in May, and it’s likely to provide more evidence that policy-makers have pulled off a soft landing in the market – for now."

The experts have spoken.

^, oops

Crea

I need some financial advice... I've got 700k cash. Stable job. Average pay 45k.

Should I 1)buy 3 cheap apt/condo near dt and rent them out?

or 2) buy a house and rent out 2beds to students around uvic?

Thanks

@Tren:

Are those the only two options? I would consider something more diversified like a balanced set of index funds, unless there something about real estate that makes it a good investment for you.

Even if you decide to buy, I'm not sure paying cash is the best option. Mortgages remain cheap.

Time to break out the spreadsheets, I think. What would the cash flow look like for those properties?

Monday, June 17, 2013 8:00am

MTD June

2013 2012

Net Unconditional Sales: 341 637

New Listings: 730 1,449

Active Listings: 4,848 5,189

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Well Tren, your limited options show that you are not comfortable with buying stocks and bonds.

You're a real estate man and you're not going to change no matter what anyone will ever say to you.

But with 700K - you don't have to buy the property. You can supply the mortgage to the poor sap buying the property. Private mortgage money at 12%

No maintenance, no property taxes, no management, no tenants. Just a check each month.

And you can choose who and what property you want to lend on.

You're not going to get rich buying real estate anymore. You'll make your money by supplying the pick axes and shovels to the Gold miners.

Post a Comment