I've made it no secret that I hold considerable reservations about purchasing a condo. I can think of a hundred reasons why it would be a bad decision for us and only a few good reasons: affordability being the paramount of those.

I thought it prudent to run a similar set of numbers to those

I did here a few days ago. We'll work with similar assumptions:

- Annual income of $72,000

- Condo purchase price of $230K. Why that? It's well below average, but if we really bought a condo, we'd refuse to spend more.

- We'll continue to use 10% down payment, because it isn't that big of a stretch, and I'm guessing there are more than their fair share of people (kids) out there who have gotten $25K "gifts" from parents to get into this market before they are priced out forever.

- Again we've used 30 years for amortization; likely this is average these days.

Scenario One: buy today, pay later...

So

we find something we can live with and go get the mortgage. Posted rate was 5.85% for five years, we get 5.25%. Here's what it looks like:

Again we'll pay bi-weekly. So we give the bank a total of $1048.46/month. I'm assuming an average annual property tax of $1200, this is an unscientific average based on "observation" rather than calculation, we'll do the same with strata fees or monthly assessment at $175/month.

MA's in this town vary incredibly. We've seen them as low as $113 and as high as $280/month. Most hover about $20 under $200. We'll use 0.05% as the maintenance charge: while the MA covers common maintenance, it won't replace appliances, floors, paint and fixtures, which in our experience walking through condos in this price range all need replacing. We'll call that $1150/year or $96/month.

Total monthly ownership related costs then are: $100 + $96 + $175 + $1048.46 = $1419.46. This represents roughly 24% of our

pre-tax income. This falls well into our fundamentals (33% of gross income). We could even qualify for much more of a purchase price with the bank if we chose.

Scenario Two: Five years later

Again the interest rate has crept up to historical norms of 7.5%. We've managed to "build" $16,561 in equity out of the roughly $70K we've given the bank thus far. Here's what it looks like when we go to renew:

No surprises here: our monthly payments have increased with the hike in interest rate. Now we're giving the bank $1286/month or a hike of almost 20%/month all because of a 2.25% interest rate increase. We'll keep similar numbers for the other "ownership expenses" and increase our income with inflation to $6500/month.

Now we're out of pocket $1657/month for our housing costs which is 25% of our

pre-tax income. Again this is all keeping within those sneaky fundamentals we keep using in our calculations, and despite a 20% increase in mortgage payments, we are only eating into an additional 2% of our gross income.

Now looking at these calculations, we can see where there are some "issues". For laziness's sake, we didn't "calculate" increases to taxes, MA and maintenance charges, simply because using inflation numbers here will likely prove incorrect: taxes, maintenance and MA charges increase or decrease arbitrarily not based on CPI. I don't think one can predict any changes in these areas. Instead we'd just have to hope they aren't drastic changes and adapt. We think that fairly easy and affordable to do when it comes to making this kind of a purchase in this market.

If you're new to this blog, you may be wondering why we haven't jumped at buying a condo given these financial circumstances. Truth be told, we're close to that $72K income (I used that because it is somewhere between the median and average household incomes in Victoria, not because it's ours). That said, we actually will make a fair bit more than that this year, so in fact, if we spent $230K on a condo right now, we'd be well under the financial fundamentals we like to use so much. So why haven't we done it yet?

Because there is no way that we would spend that much money on the junk we look at in the neighbourhoods available to us in that price range in this market. Since February 2007, we've watched the low-end condo market have a sales to list ratio of about 50%. That means for every 2 condos listed, only one sold. Sure some were pulled off market, but they didn't sell. Guess what we think that means? You bet, a correction will have to come if that sales to list ratio is to gain and not lose. Can we predict when that will be? Nope. But we can be patient because despite those numbers it still is cheaper to rent a 2 bed 1 bath condo in this town than it is to own.

I can say this with all certainty. The first property we looked at was a 2 bed one bath condo of just under 700SF. The landlord wanted $975/month in rent. It was a nice place in a central location. She had no trouble renting it. She's our Realtor now. She found us the same suite, 1 floor up in the same building for sale at $230K (we had the option of buying before it got listed). It has a MA of $170/month and just over $1250/year in taxes. Surprise, surprise, really close to the numbers we used in the calculations above: Own = $1420/month, Rent = $980/month. I recognize this is anecdotal. But we also originally thought she was asking way too much in rent for her place.

Is pride of ownership worth $440/month or a 30%

premium. Maybe. But if you feel as certain as we do that the condo market especially will be hit with a correction (how big?) then you'd better be certain it's worth more than a 30% premium because it may end up costing you closer to 50%.

After several conversations with our agent, we learned she paid $160K for her place in the same building 2 years ago. Using those numbers, she's still subsidizing her tenant's rent. An investment property indeed.

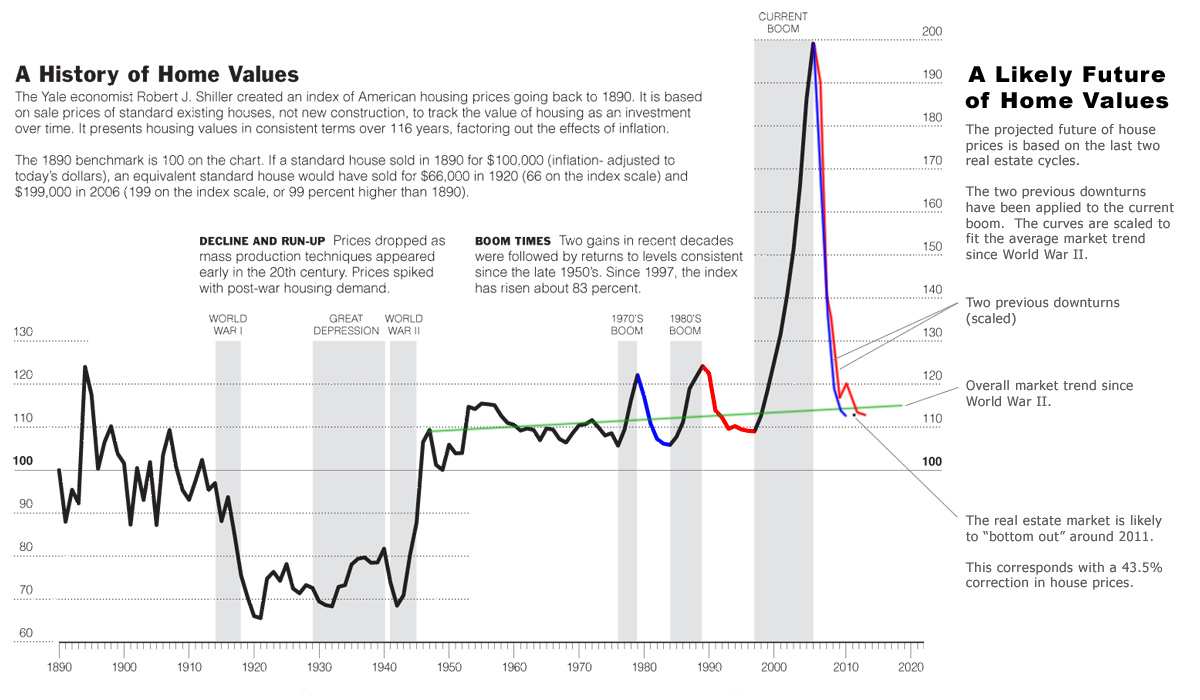

You really should read this. I know it's American, and I know it's different here, except it's not. Because it never has been. And likely never will be. Click here for a better view of above image rather than the image itself. Blogger was acting up tonight.

You really should read this. I know it's American, and I know it's different here, except it's not. Because it never has been. And likely never will be. Click here for a better view of above image rather than the image itself. Blogger was acting up tonight.