You really should read this. I know it's American, and I know it's different here, except it's not. Because it never has been. And likely never will be. Click here for a better view of above image rather than the image itself. Blogger was acting up tonight.

You really should read this. I know it's American, and I know it's different here, except it's not. Because it never has been. And likely never will be. Click here for a better view of above image rather than the image itself. Blogger was acting up tonight.

18 comments:

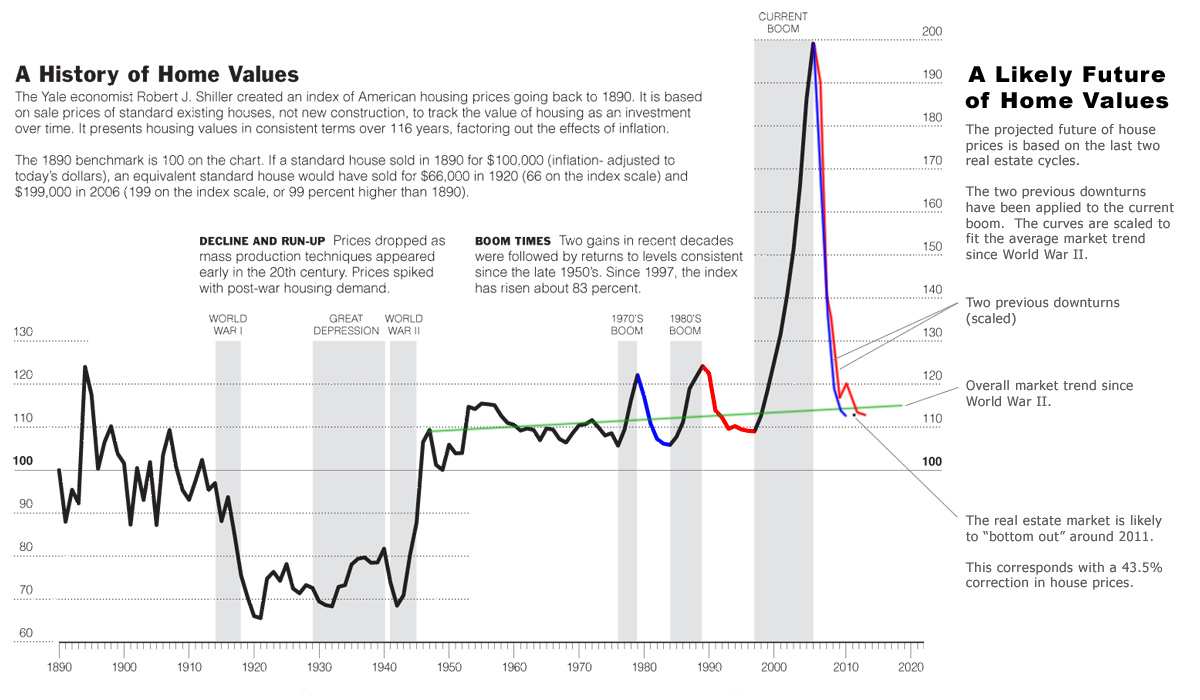

Shiller's work in popularizing this data is brilliant, the visual image says it all...

I wish I could get my hands on stats that were Canadian that went back that far - has anyone seen a similar graph for the Canadian housing market?

Presumably the graph is considers inflation in it's indexing, but perhaps their prediction accounts for a conservative inflation rate (say 1.5%). I certainly remember the recession in the early 80's as a child, it was lean times and inflation was up and the housing was popping due to high interest rates (13%). It was actually these astronomical interest rates that triggered a massive foreclosure pushing down RE prices, aptly named market correction.

I also recall those that benefited from those times were the investors that didn't need to take out large loans for their RE/investments. So what's different here? Find a graph that also overlays the following information:

- inflation rates

- bank rates

- CDN vs US dollar perhaps

- and perhaps the price of oil

- demographic distribution

So what will be the avalanche factor in the near future to cause the correction? Perhaps it will not be any single remarkable attribute of the economy as in times past and I suspect it will have a lot more to do with our demographics. Why? Well people aren't having as many kids as they used to, they are having children later in life, and poeple are living much longer. This might not cause such dramatic avalanche as predicted, but rather a slow erosion of the index price. However, the impact of continually high oil prices might eventually factor into inflation, but I haven't seen that happen yet and obviously the Bank of Canada hasn't seen it either.

Tyrell, why is the bank talking about raising rates this summer if they aren't seeing inflation? Also what were the lowest rates in the early '80s? 4.5%? I don't think so.

I do wonder about this plot. It looks nothing like the S&P Case-Shiller index available at Standard and Poors. That data shows a tiny real drop after 1990, not the huge plunge in the popular plot.

I don't have a copy of Irrational Exuberance, but it seems Shiller's methods have changed considerably from when he made the index with Case. How malleable these statistics are is spoken to by how different the S&P index is from the one used by the OFHEO, who claim the same methodology. It all sounds like a good idea, but strikes me as incredibly difficult data manipulation task.

Mr Anonymous, check your figures. According to http://www.bcrealtor.com/d_bkcan.htm in the eraly eighty's the Bank rate was as mostly around 15% and as high as 20%. The BoC is finally talking about a rate hike this summer becuase of the unexpected rise in inflation, precisely what the rate hikes attempt to address. But you will see that the rate hike will not even be close to 15% interest, let alone 20%.

I dunno, there's a lot of evidence suggesting that real inflation is a lot higher than the so-called "core" inflation used by the BoC, and even that may be underreported in order to artificially inflate reported GDP growth. At some point they have to face up to reality. I'd be surprised if the prime rate hits 15% again, but 10% doesn't seem outside the realm of possibility. They may not include oil and gas in the CPI, but as the price of fuel goes up the price of everything else will go up too.

Food has gone up 11% in 2006-07 according to McLean's.

Also the real gap between inflation and interest rates is very similar now as it was in 1982; which is only between 3-4%.

Don't know what this means, but I suspect that it is a significant fact that should not be overlooked.

I'm confused about the CPI. Does it or does it NOT contain food and fuel?

From bankofcanada.ca - the footnotes...

1. Core CPI: The CPI excluding eight of the most volatile components (fruit, vegetables, gasoline, fuel oil, natural gas, mortgage interest, inter-city transportation and tobacco products) as well as the effect of changes in indirect taxes on the remaining components.

2. CPI-XFET: The CPI excluding food, energy and the effect of changes in indirect taxes.

talus,

I'm pretty sure that in this decade the CPI counters that be have dropped all kinds of things out of their count... so I wonder if they even know what it includes anymore.

As you've posted those two descriptions they look the same to me, one just a bit more detailed.

There are more details on the various CPI stats at the BOC site. It looks like they have to make all sorts of asumptions in order to come up with the CPI, but at least they acknowledge it.

It makes sense to me how raising interest rates may reduce credit expansion (reducing the ability or drive to incur more debt), but I don't understand how raising or lowering short rates has any impact on the prices of specific items such as vegetables or oil - aren't the prices on these simply market driven and have nothing to do with inflation? And is credit expansion backed by nothing really inflation anyways? I know it is called inflation, but is it really? Why is this so confusing?Is it the terms that are used that are confusing?

I don't understand how raising or lowering short rates has any impact on the prices of specific items such as vegetables or oil

I think you can think of raising the interest rate as removing money from the spending pool. Imagine if the government suddenly printed 30% more $100 bills and gave them to everyone. The demand for goods would be the same, but folks would have more money so prices would rise. Same with interest rates. High rates, and people keep money in banks. Low rates, and folks borrow money, increasing the cash in circulation.

Have a peak at the wikipedia under inflation.

jmk,

Except now while credit and debt may still be expanding, wages and savings are decreasing, so is this really true inflation?

Do you think the price of vegetables and oil is increasing mostly because people are able (via lower interest rates) to take on more debt, even though they actually have less money?

I will check out the wikipedia, thanks, however I'm not sure if it is the terminology that is confusing to me to the vast differences in economic theories and ideas.

It seems to me that an expansion backed by savings should be termed differently than a credit bubble backed by nothing. They are obviously not the same thing.

Hi Olives

Do you think the price of vegetables and oil is increasing mostly because people are able (via lower interest rates) to take on more debt, even though they actually have less money?

I think prices increase for a lot of reasons. Mostly because everyone in society is happiest if they get a better price for their goods and services. Dishwasher dealer x tries to get the most money for the dishwasher he can and still make a sale and prices creep up. Consumer y wants a dishwasher, but needs to ask for a raise to get it. Their employer's costs go up, so they have to raise their prices, etc etc.

Prices also go up and down based on the saving rate of consumers. if they save a lot, or borrow a lot, that changes the ammount of spending. Raising and lowering the interet rates changes the amount of spending.

I don't think that inflation is measured relative to wages. i.e. inflation can go up without wages going up. So yes, if every consumer decides to go neck deep in debt and drives up prices, I think that is what most people would call inflation. One way to control inflation is to make such borrowing more difficult. (Someone with real economics knowledge should correct me if I'm wrong.)

All the commentary I have read this weekend is that a half point rate hike by Christmas (two quarter point hikes) is a given for Canada. This is the lid the real estate market here needs,throw in the threat of further hikes past Christmas after the first one kicks in thru the fall and I would imagine another segement of FTB's will not qualify,in other words look out below.

tyrell family, remember that you don't need 15%-20 % rates for the same effect as 1981 crash, 7-8% will have the same effect with these inflated prices. The monthly increase in mortgage payments will equal or exceed the same amount that occured in 1981 that forced people to sell or walk away. Most households would not be able to pay a 25% or more increase as a high percentage got in a few years back at 3%. Something has to give the other way when interest rates go up and the affordability index is at 1981 levels right now,economics 101.

Hi VG,

Thats true, but hoping for higher interest rates doesn't really help FTBs. Every 1% increase in interest rates means they need to see house prices drop by 17.5% in order to avoid paying more in interest for their new house. In order to make the same monthly payment (and still pay more to the bank in interest), they will have to see house prices drop 10%.

This is no-doubt great for folks with lots of cash who don't need to finance. But higher interest rates are not necessarily good news for FTBs.

Agreed to a point jmk, but as we have discussed in the past in 1981 the rates started to creep up only a little bit (as in a half point to a point above the previous several years of 13% rates). This began the long way down for house prices over the next 2 years where the rates kept increasing but by the spring of 1983 they had returned to the 13% range making housing affordable again. I remember it well as I previously discussed on here selling in 81 and buying back in 83.

I imagine any rate increase of 1% won't have much effect on houses outside of BC and Alberta cause the average house prices there are at decent levels. What we have here is a market clearly out of control as much as the bulls and the real estate sales people want to deny this simple fact. We aren't different,we're overvalued and a correction of 30% will not be considered out of the norm.

You are of course right jmk, higher interest rates are not good for anyone, and mostly for FTBs... but these FTBs are looking forward to the potential for a correction that they bring... then when the market goes south and stagnates, along with the usual recession that goes with, low interest rates usually occur to spark a way out... then we get to cycle up again and so the market replay a goes.

Post a Comment