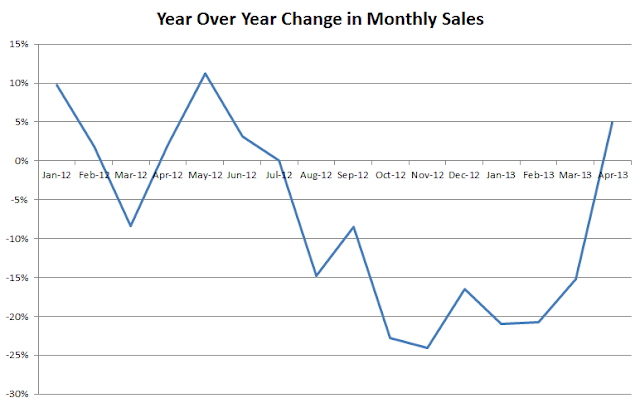

Total sales for the year are still the slowest in well over a decade, and well behind even the last sluggish years.

Update: The VREB doesn't have much to say this month. Apparently we are back to that "balanced" market in Victoria, which is one of the VREB's favourite words when the market is slow. Some points of interest:

- SFH sales up 15% YoY while condo sales are down 15%.

- Median SFH price down 3.3% YoY, average price up 7%

106 comments:

Poor Metchosin, no sales for you even in the spring market.

Look at that flat line from 2008. So far I am the most right in my predictions!

And thanks again Leo for your hard work and neutral presentation of the data here.

No need to worry. Canadians are a prudent bunch.

Personal Bankruptcy Canada: Canadians Losing Cognitive Connection to Cash

From that article "insolvencies up 20.9 percent" That is a month to month stat that seems to be a genral spike that happens in January. from the stats they pulled from "The total number of insolvencies in January 2013 was 3.8 percent higher than the total number of insolvencies in January 2012. Consumer insolvencies have increased by 4.5 percent, while business insolvencies have decreased by 13.8 percent." But that doesn't sound as shocking as 20.9% does it?

As a general rule: a news article that references statistics is at best missing half the picture, and at worst actively misleading

Even if Teranet mellows to half the pace (1.6), that’s still a 20% per annum pace. Strange how we’re the weakest link in the country. What will April bring? Another 3%?

Teranet said Victoria’s index fell 3.2 per cent in March, the biggest one-month drop for the city in nearly 23 years of data recording.

http://www.winnipegfreepress.com/business/finance/teranets-march-house-price-index-breaks-string-of-month-to-month-declines-203402281.html?device=mobile

"In an example he has used before, Carney said the Bank of Canada now realizes that it may need to take an active role in preventing a housing bubble that could impact the wider economy. Effectively, that means the bank is prepared to raise interest rates if necessary to slow down borrowing."

But that will hurt good honest people that are not taking on so much debt.

Sorry home owners, your going to have to take one for the team.

"But Carney says there are limits to flexibility in conducting monetary policy. He said if markets lost trust in central banks, their effectiveness will be greatly diminished."

Ooh scary.

Central banks must adopt new approaches for handling, preventing crises: Carney

Poor Metchosin, no sales for you even in the spring market.

Relatively no one wants to buy in a rural area miles and miles away from the core? Shocking.

And thanks again Leo for your hard work and neutral presentation of the data here.

Leo works hard, but neutral he ain't.

"Relatively no one wants to buy in a rural area miles and miles away from the core? Shocking."

Then shouldn't the prices be a lot lower out there?

How did they get so high in the first place?

If no one wants them.

>> Leo works hard, but neutral he ain't.

Yep. If I was I wouldn't bother to post

How did they get so high in the first place?

If no one wants them.

Irrational exuberance, which is long gone by now. Even so, prices in the core have remained quite high; that should tell you something.

Yep. If I was I wouldn't bother to post

True dat.

Was there irrational exuberance in the core?

I meant the data presentation not the words ;-)

“If that happens, we will price ourselves out of the market again,” she said. “The advice will be to ‘not go there’ because if [a seller] does it will be a standoff. Educated buyers are in the marketplace and they are not going to pay inflated prices. Sellers have to stay within the market range.”

The new new normal.

Sales surge rebalances Greater Victoria’s real estate, board says

"What’s more, Canadians appear to be less willing to postpone major purchases such as new cars, houses and renovations."

Don't delay go out and buy that major purchase now. You've earned it.

Interest rates are low and the banks are just giving money away.

http://www.pwc.com/en_CA/ca/banking-capital-markets/publications/pwc-consumer-lending-survey-2013-04-en.pdf

kooz is right: interest rates can go up "any time." Of course, interest rates can also go down any time.

Central Bank Takes Step as Europe’s Downturn Drags On

The European Central Bank cut its benchmark interest rate to ... 0.5 percent from 0.75 percent, which was already a record low.

Even at its new low of 0.5 percent, the European Central Bank’s benchmark rate remains higher than the 0.25 percent rate the Federal Reserve has had in place since late 2008. On Wednesday, the Fed said it would maintain its stimulus campaign, buying $85 billion a month in Treasury and mortgage-backed securities. The Fed added that it would consider adjusting its efforts to spur growth and reduce unemployment in the United States.

Many economists argued that the central bank was practically obliged to cut rates. Inflation in the euro zone was just 1.2 percent in April, well below the E.C.B. target of about 2 percent. The central bank is mandated to maintain price stability above all else, which includes heading off deflation — a downward spiral in prices that can be even more destructive than inflation.

Good news for me RE using credit cards. I have shares in VISA!

From Introvert's article above:

"The central bank will continue providing unlimited loans to banks at the benchmark interest rate “as long as needed” and at least until mid-2014, Mr. Draghi said at a news conference after the announcement."

The recovery is schedule for next year.

Prosperity is just around the corner friends.

"HOT BALANCED MARKET!"

Get it quick while the market is in a state of oxymoronism.

http://www.realtor.ca/propertyDetails.aspx?propertyId=13129294&PidKey=520627620

"DO YOU HAVE A LARGE FAMILY, NEED QUALITY ACCOMMODATION FOR MOM & DAD, WANT A HUGE WORKSHOP/STUDIO & LONG FOR COMPL PRIVACY ON YOUR OWN COUNTRY ESTATE?"

...

"Priced $124K under 2013 assess value. Outstanding value."

C'mon guys, surely it's worth a measly half a million dollars.

80% of assessed and everything.

Where oh where is the bottom of the market for these suddenly undesirable rural properties?

http://www.realtor.ca/propertyDetails.aspx?propertyId=12897871&PidKey=-327820338

Prosperity is just around the corner friends.

I can't afford prosperity right now; my mortgage renewal is coming up!

4 Canadian banks on Top 10 list of world's strongest

I have a new favourite realtor!

Jack Beer

"$150,000.00 price reduction..."

Ok, looks good so far.

"This property has been reduced in price by $150,000.00. Seller is motivated to sell. Second revenue house ($1,400 per month x 12 = 16,800 per year)!!"

Haha, good luck trying to get someone to rent out there.

Assessed: $603,000

Listed: $598,800

At 99% of assessed this puppy is sure to fly off the store shelves.

What were they thinking when they came to market at $750,000??

http://www.realtor.ca/propertyDetails.aspx?propertyId=13121791&PidKey=-484929156

Koozdra, thanks for the links....

Carney preaching against a housing bubble was priceless.

:-)

koozdra - you must look at a lot of listings :-)

I have to admit the one advertising complete privacy but having an attached 2 BR suite was pretty laughable!

The sales blip is surely the result of NDP politicians, aids, advisers and hangers on buying up the better properties in anticipation of the good life in power.

And the availability of under-the-counter mortgages below last year's 2.99% adds a little to affordability. The only thing Carney would hate more on his watch than a bubble is a crash.

And, of course, it's spring. We should see a 10-15% gain on the mid-winter low if all other things are equal. So far, the uptick in the median price is only about half that.

Carney's almost gone..

Tiff!!

It's not Tiff!

Stephen Poloz

Re: Stephen Poloz

Seems like a cushy job. To keep the bank rate at 1% or not to keep the bank rate at 1%. That is the question. I think I could decide that myself for a salary of between $431,800 and $507,900.

"To keep the bank rate at 1% or not to keep the bank rate at 1%. That is the question."

It is an interesting question.

Canadians have a huge amount of confidence in our housing market and economy. They are taking on excessive amounts of debt based on that hubris.

When the recovery starts to ramp up (whenever that happens) interest rates will need to be adjusted upwards.

How do you do this when people are depending on those low rates to service the debt they carry?

I have a suggestion:

Fluctuate the rates randomly, but only by a little. You need to waiver people's belief that rates "aren't going up any time soon". Or at least imply that there is an element of risk.

The up side is that we avoided a massive recession. The downside is that the recovery will be that much harder. It might not even be impossible at these debt loads without considerable pain.

"Naysayers believe Canada may be too optimistic and relying heavily on that old saw that Canada is not nearly as reckless as the United States. After all, the debt-to-income ratio of Canadians is at a record high, close to the levels experienced in the United States before its market crashed, and home ownership is at nearly 70 percent, also a record and five points more than its neighbors to the south."

...

"..the sub-prime market is tiny.."

Shhhh... don't tell them about the whole CMHC thing.

Canadian housing - bursting bubble or gentle landing?

Broadmead townhouse bought October 2005 for $645,000. Today's sale price $610,000

Sidney retirement rancher bought November 2007 for $398,000. Sold this week for $360,000

Langford condo bought from the developer May 2008 for $314,900. Sold after 71 days for $254,500

Shawnigan Lake waterfront purchased June 2007 for $625,000. Sold for $510,000

Tear-down on Millgrove bought January 2007 for $360,000. Five years later and still not torn down sold for $372,500.

Fernwood character home bought June 2005 for $405,000. Sold above asking price for $601,000.

"One of these sales is not like the others - see if you can spot which one?"

Langford condo bought from the developer May 2008 for $314,900. Sold after 71 days for $254,500

Someone just lost ninety thousand dollars.

2008: $314,900.00

2013: $343,705.24

343,705.24 - 254,500.00 = $89,205.24

Broadmead townhouse bought October 2005 for $645,000. Today's sale price $610,000

Wow, it's expensive to be rich.

2005: $645,000

2013: $745,724

745,724 - 610,000 = $135,724

Shawnigan Lake waterfront purchased June 2007 for $625,000. Sold for $510,000

2007: $625,000

2013: $691,381

691,381 - 510,000 = $181,381 loss

Hi HHV regulars (and possibly other 'readers but not posters'):

A have a question that I'm hoping some of you may be able to provide some information on, point me in the right direction for follow up, etc.

I own a rental property which a developer has expressed interest in purchasing. Because it is the land, not the house, that he is interested in for future development (there is an active development application pending regarding 3 adjoining lots), I'm not certain what metrics/numbers I should be using to respond to him. I'm not certain assessment value or a market guestimate are fully relevant.

There must a market-based price per square foot land value that I could apply to my lot size. Any tips on how I can research/access resources to assist me here? Would the planning department at the District of Saanich be any help, do you think? Or maybe the local Urban Development chapter (developer association i think)?

This seems like a very knowledgable online community so I appreciate whatever information you feel like sharing.

Thanks

@Katyusha

What did you buy it for and when?

No integrity left in the media...I can't believe it??

Sleazevertising

@Katyusha

It all depends on density utility of your property - does it give the developer two more townhomes or 10 more condos? Last year I was approached by a seller on Shelburne (City of Victoria) wanting to sell a family home. Market value was approximately $350,000 - $360,000. I ended up talking to the neighbour who was also interested, as well the home two over. I managed to convince them all to list at the same time for $415k, $425k, $415k and they got $400k, $401k, $397k. A large well know developer bought the three homes and will develop in the future.

How did I figure out what to price them at? Fairly simply. I talked to the city and got a ballpark on density (townhomes), approximated construction costs, and I had a good idea of what the finished product would sell for. I knew that it wouldn't fly beyond a certain number - developers wouldn't have even margin.

>> Or maybe the seller purchased another property that was 90k or more less than it's original/assessed value, in which case they didn't lose anything

That is some seriously twisted logic you've got going.

Ernie, can you walk us through some math of what your saying.

Actually there is no logic in what I said. As an excuse, I'd offer up that I need more sleep, but that isn't true, I just wasn't using my noodle :) If you're on the hook with the bank for 90k you're on the hook. I retract my comments.

@Marko

Thanks for the response. I have a better idea of how to approach things now.

@kouzdra

I didn't reply to you as your questions weren't relevant to my enquiries, but thank you nonetheless.

Katyusha,

The developer may only want the land - but they'll have to pay the price based on your property's Highest and Best Use. And that may not be as vacant land - but as its current use as a "house on a lot". Why would you sell your property for less to a developer when an investor or home owner will pay more for its current use?

Best to get a professional valuation of the property from an unbiased source. A written, signed and dated appraisal report performed by a Real Estate Appraisal Company.

That written report will present all of the analysis that you are seeking in order to make an informed decision. Raw land value, development costs, profit margins, marketing times, etc. All in a 30 page or so written report.

Thank you, Just Jack. Excellent suggestion and I will do just that.

Re: selling "for less" to a developer, that certainly isn't my intent. My reference to not being certain if 2013 assessment value and/or market price were the right valuators is most definitely because I want to identify the correct analytics and extract maximum value :)

And if I cannot, then I retain a profitable rental with solid tenants!

I think your first step is to have your property valued as it is today as a house on a lot and compare that to what the developer is offering. That will cost you between $225 to $350 depending on who you have appraise the property and what other information that you instruct the appraiser to gather.

What Marko suggested is more a study that the developer would use to determine their break even point. And that can vary from developer to developer just because one developer is getting a better deal on materials and labor than the other or wanting a smaller profit margin.

What you're most interested in is the value of the home today in relation to what developers have paid for raw undeveloped land in the recent past expressed as a lump sum or as price per square foot of buildable area. Because at the end of the day - all you want to know is or isn't the developer's offer reasonable?

Is Canada's Economy in for a Housing Shock?

"Conduct of Sales" are murdering the strata home market. Too much inventory and too few sales are turning the strata home fair value market into a "foreclosure Market".

That means "trough" pricing by agents as they set strata home asking prices just below the last sale price in the complex. The inventory in relation to sales has grown to the point that selling prices for strata homes under duress circumstances have fallen back to 2005 levels.

That doesn't mean your condominium or townhome has fallen to that level. Those newer complexs in premium hoods still get good prices. But that is a very small market niche. A niche that changes with time. A five year old downtown condo is still in demand - but not a ten year old downtown condo.

A dozen years ago when sewers were being extended out to the Western Communities, prices in nearby recently completed subdivisions began their accent. One of the first subdivisions that was affected was Stoneridge in View Royal

A dozen years ago, you could buy a 1,700 square foot home for $265,000in Stoneridge. Those homes rapidly appreciated and reached into the low $500,000 price range. Now those home prices have sunk into the mid to high $400,000 range.

1,331 condominium and townhomes for sale in the Greater Victoria areas with 211 sales last month. Last month 444 strata homes were listed for sale. 2 condos being listed for every one that sold.

37 of those strata homes listed for sale sold in under 30 days. The Sale to Assesment Ratio ranging from a low of 80% to a high of 116% with the median quick sale strata home selling 3.5% below the government valuation of July 1, 2012.

Last month the cheapest condominium sold for $148,500 in Saanich West. A 40 year old 636 square foot second floor suite.

The typical or middle of the road condominium sold for $318,000 but you got more square footage than in previous years. The typical condo being a 17 year old suite with 1,125 square feet in a Downtown neigborhood.

But the luxury condominium market is flooded with options. The highest priced resale condo sold last month for $700,000, in the now ten year old Shoal Point Complex, which was at a deep discount from its previous sale price paid in May 2007 at $880,000.

"$10,000 cash back on closing to help closing costs"

Don't think of it as a cash back offer on an extremely over priced property. Think of it as instant equity extraction on your investment.

http://www.realtor.ca/propertyDetails.aspx?propertyId=12241715&PidKey=1943212222

5% down on a $500,000 property is $25,000. So a $10,000 cash back that is not declared to the lender or CMHC is skipping/dancing/pole vaulting around the rules.

Let's say you're a mortgage broker and you forget to disclose this cash back to the bank or CMHC. What would happen to you?

Probably nothing.

But if the property were to be insured by CMHC and then go into default, the CMHC auditors could nullify the insurance to the bank. If it isn't disclosed then it's fraud. Insurance programs do not pay out for fraud.

Another tightening of the bank's lending sphincter happened yesterday. BMO will no longer allow appraisals performed on million dollar plus homes by non qualified (designated)appraisers. What the hell were they doing before!

With over 5000 homes listed for over a million bucks in Vancouver that might cause a back log for lenders. Luckily Greater Victoria only has 350 homes asking over a million out of the 3,100 properties listed.

I heard, but not confirmed, that Vancouver now has more million plus homes listed for sale than in all of the continental USA.

Condo owners most likely to get original asking price

Vancouver now has more million plus homes listed for sale than in all of the continental USA.

I think that's a bit exaggerated, but note that there are currently 3128 properties listed over $1 million in Los Angeles County (population 9,889,056), one of the most expensive markets in the US.

If the Socialists get elected in the Provincial election, watch house prices in Victoria crash.

In 1975 the NDP got elected and by 1978 property prices in Victoria had crashed, but then they sky-rocketed immediately after we kicked out the socialists.

During the 1990's the NDP's reign of incompetence destroyed house prices once again; but then prices sky-rocketed after we kicked out the socialists.

I know, I know... "It's different now"

Vote NDP if you want house prices to decline rapidly for 4 years.

Do Not vote NDP if you want house prices to stay level.

It would be cool if B.C. did have an actual socialist party; I don't think the NDP is it.

There's a Communist running in Victoria–Beacon Hill. Heard him on CFAX the other day. I agreed with most of his positions.

There's also a Work Less Party (with a slate of two candidates). It believes we should work less, produce less, and consume less. Now there's a platform I can get on board with.

"but then prices sky-rocketed after we kicked out the socialists."

So getting rid of the NDP in 2001 set off a worldwide bull market in housing? Wow!

Also I'd like to see your "reasoning" for how the Dave Barrett NDP (1972-75) caused a supposed 1975-78 housing bust.

LeoM - kindly delete your post.

The last time I checked this is not a political blog and I would guess that a large number of us do not appreciate what is clear political trolling (use of talking points is a good indicator).

I would say the same if it were political trolling for any other party.

Thanks.

I miss the Natural Law party.

Bubbling bliss...

would vote for them for sure

There's also a Work Less Party (with a slate of two candidates). It believes we should work less, produce less, and consume less.

Ha Ha, no thanks.

"Executive home, without the executive price"

Don't fret proletariat friends...

"...LEGAL one bedroom mortgage helper..."

Much better, someone will buy it for sure now.

http://www.realtor.ca/propertyDetails.aspx?propertyId=13136096&PidKey=1014544348

Thoughts on 1751 San Juan?

Surprised it hasn't sold yet...

Dead end street, across from a park, amazing house.

Even has a carriage house in the back.

Might be slightly over priced still IMO. "Built in

1974" Are they original windows? Location is not bad. I like MD. Not the greatest walking neighbour hood from an urban perspective but good parks and close to stuff etc. Could be worth a look and an introductory offer to see if they will play ball...

across from a park

Might be one of the reasons it's still up. That park can be noisy.

Looks better than some of the other homes I've seen in Gordon Head recently.

It believes we should work less, produce less, and consume less.

As opposed to what we have now - work less, produce less, and consume more, aka the debt based economy. At least they're consistent.

"COURT ORDERED SALE."

..

". Large legal 2 bedroom suite with potential for a seperate bachelor of +/- 1,038 sq. ft."

Assessed: $553,000

Listed: $519,000

Who is the target audience here?

Young professional? Well according to the densification theory people are moving to urban centers for work so they don't have to drive.

(That's why we built so many condo buildings.)

How much can you charge for that suite? (dumb: As much as you want since our "vacancy rate is low".)

Rich retiree? I thought they were all downsizing to condos and moving to the city.

(That's why we built so many condo buildings.)

Or maybe it's the quickly evaporating and elusive "investor"?

http://www.realtor.ca/propertyDetails.aspx?propertyId=13049527&PidKey=2118930992

The "executive home" with a suite is quite funny to me. You have lived through the wealth creation period in Canadian history. You have indentured some young person to a lifetime of debt by selling them your old dilapidated home you bought for half the price.

Now it's time to "move up".

You are rich, do you want some cretin occupying your basement?

Or maybe it's not even "executive" people that are buying these executive homes. Maybe they are even just managers or workers that think there is no risk in real estate.

Life plan:

Buy "executive" home.

Stop saving, divert full income to servicing behemoth mortgage.

Live in house with vile renter.

Gain money from appreciation when selling.

The crash will come as a bit of a shock to these people.

Oh those poor first time home buyers...

"But the price tag wasn't the only sting. Her financial institution turned her down for a line of credit to make a deposit on her new home while it was being built."

What has the world come to?

You can't even borrow your down payment any more?

http://www.winnipegfreepress.com/business/the-first-time-homebuyers-dilemma-206074081.html

"I had been banking with them all my life," she says. "All my debt combined is under $100,000 so for them not to be able to give me a $15,000 line of credit to buy this house, when I make good money and have never been late on payments, it's a little ridiculous."

The banks are being unreasonable. All her debts are under ONE HUNDRED THOUSAND DOLLARS. Surely at these low rates she can service this debt. What's another 15 thousand?

Here's the real question:

Where the banks giving out 100% percent financing?

That sounds REALLY familiar.

"A recent survey by TD Canada Trust found more than half of those who would like to buy a home are struggling to come up with a down payment, in large part because of soaring real estate prices over the last few years."

Let me restate this for the full effect:

More that half of first time buyers are struggling to come up with 5% of the total value of a property.

FIVE PERCENT IS TOO MUCH!

Don't worry though, it's not happening here, just everywhere else. It's different here.

It took me ten years of working to be able to buy my first house. It's tough to save money. That's hardly news...

"It took me ten years of working to be able to buy my first house. It's tough to save money. That's hardly news..."

Were you saving for 5% of the total value?

As for the person who could not get a down payment for her purchase. Her bank was correct not to give her the loan until her first house sold. A lot of people, including professional real estate agents, incorrectly call what she is doing "bridge" financing. It isn't bridge financing what she is doing is owning two homes.

Bridge financing happens when you have an accepted offer on your first home and the second home you bought closes before the first one. You want to bridge that short period of time between when you have to pay for your second home and the first isn't closing till later.

The second lender, where she got her financing, is gambling that her first home will sell high enough and soon. If that doesn't happen she will large additional fees for high ratio financing or she could potentially lose both homes in foreclosure. If you have your bank account with the second bank, you should immediately close your account. The wanker banker is just gambling with your and every other bank members' deposits. The banker has also willfully placed their client in financial jeopardy.

What Just Jack said.... I might also add that she doesn't sound financially prudent. She "bought her childhood home five years ago for $85,000" and right now she is 100k in debt? If she borrowed the full amount that's $470/month in payments! Maybe if she was paying off her other debts instead of buying $500 shoes (or whatever she has frittered her money away on) then she wouldn't be in this situation. She obviously wasn't investing her extra income either....

Dasmo, how dare you criticize our banks. They adhere to strict lending guidelines. One might even make the logical leap to proclaim that we have the best regulated banks in the world. I mean we did declare them too big to fail, right?

If the banks deem that Marnie can handle another $240,000 in debt on top of her already $100,000 debt and yet another institution is willing to front her some dough for the transaction then it must be the right decision.

One might ask why this is even news at all. Is this a strange event?

Getting turned down for a measly fifteen grand loan is out of the ordinary?

Well, it is out of the ordinary.

There was a time when house prices were rising and rising. Every banking institution was rushing to loan out as much of that juicy government insured money as they could.

Things are a little different now. Apparently, and I'm not an economist here but, there is risk in the housing sector. Prices don't just go up.

Banks aren't just giving money away any more.

>> borrowed the full amount that's $470/month in payments

Hard to fathom after living in the reality distortion field for so long, but there are places where buying a home doesn't put you in the poor house. Also subject of Garth's blog tonight.

Husband:

Shouldn't we put a tub in there? Won't they want to take baths?

Wife:

No. We are dealing with renters here. If they had the choice they would buy their own house. We rent to these people under our terms.

Husband:

What about putting this washer and drier right beside the stove? Is that even safe?

Wife:

Yeah it's safe, don't worry about it.

"Personal and employment references will be required along with criminal record check. No smoking, no drugs."

http://victoria.en.craigslist.ca/apa/3659616104.html

Lots of "month free, reduced, free tv..." on Craigslist. Landlords must be having a tougher time scoring than the Canucks.

"$785 / 1br - 700ft"

"1 Self Board space for your horse available on the property additional charge."

We are looking for a renter that is willing to rent a one bedroom suite in Sooke that might or might not have a horse. If said renter has a horse we can offer a location to store said horse at an additional charge.

Talk about pet friendly.

http://victoria.en.craigslist.ca/apa/3760730959.html

@turesta

I have it on good authority that if you buy a condo in Constantinople you'll own one in Istanbul.

I hate Ispambul...

You are selling home ownership with these new rental posts Koozdra.

"the typical insolvent person is a 43-year-old male with more than $61,000 in unsecured debt"

This person has nothing on Marnie's $100,000 of unsecured debt.

But wait, I hear you say, insolvency rates are down...

“Joe Debtor is using credit to make ends meet, increasing an already heavy debt load that he can’t repay on his reduced income. He gets squeezed so much that the ‘house of cards’ collapses and he has no alternative but to file a consumer proposal or personal bankruptcy,” said Mr. Michalos.

"house of cards", how fitting.

Face of bankruptcy: older and deeper in debt, study finds

"You are selling home ownership with these new rental posts Koozdra."

Haha, yeah.

I think we renters should unite and start heavily low balling every listing on craigslist to break the will of the landlords.

We're looking for a new rental so I'm starting the campaign...

The Victoria apartment vacancy rate increased to 2.7 per cent in

October 2012, from 2.1 per cent in October 2011.

„„The average same sample two-bedroom rent increased 0.9 per cent in October 2012, relative to October 2011.

What you will find is that nice rentals will rent quickly. Bachelor's in particular. The most commonly available type of rental is a one bedroom. If you are looking for a one bedroom in Langford you might be able to get a deal.

CMHC's Victoria Rental Report Fall 2012 also predicts a drop in vacancy rates for 2013.

Those stats are so 2012.

Monday, May 6, 2013 10:30am

MTD May

2013 2012

Net Unconditional Sales: 96 659

New Listings: 277 1,740

Active Listings: 4,568 5,015

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Totoro, you are smart landlord. You know that a single missed month of revenue is very bad. It's too bad we have a bunch of amateurs out there.

They are not willing to lower their price. I see many places listed for months on end with with no reductions.

The student exodus induced summer vacancy rate spike makes the the summer the perfect time for low balling.

We have plenty of time. Some fish will bite.

Actually, you don't have to go to Langford: Esquimalt will do.

Submarkets in Greater Victoria experiencing the highest vacancy levels included Esquimalt at 5.1% up from 4.4% and the Westshore Region up from 2011 levels of 1.6% to 4.3%

Good morning all. Here are my stats for last week:

SFH, in Vic,OB,ESQ,SE&SW having a min of 2 beds and 2 baths and priced between $375K & $775K.

Sold: 29

Avg sale price: $553K

Med sale price: $547K

13 of the 29 sales went for below BC Assessment and only 6 had advertised secondary suites.

Four homes sold in the SE areas of Gordon Head, Mount Doug & Lambrick Park. The average price was $589K.

Since I have been charting the numbers, last week had the second most volume of sales. The others were 26Jul-01 Aug 2010 at 31 sales, 9-15 July 2012 at 29 sales and 28-6 Aug 2011 at 35 sales.

Condos - Apts and Townhouses:

Pretty much in the same areas including downtown with a min of 2 beds and 2 baths and priced between $248K and $550K:

Apts:

Sold: 12

Avg sale price: $316K

Med sale price: $288K

If it had not been for the one apartment sale of $520K, the avg price would have been much lower at $298K.

Townhomes:

Sold: 8

Avg sale price: $449K

Med sale price: $448K

Townhouse sales and avg prices are trending up.

I began charting apartment & townhouse sales in mid May 2012. Last week had the most sales (apts & townhomes combined since then.

Missed one: For comparison of SFH within same criteria for SFH

30-Apr-6 May 2012

Avg price: $544K

Med sale price: $548K.

can any agent set me up with

2b2b apt at Vic,OB,ESQ,SE&SW with price range 260k-340k. no first floor pls.

my email is at vicphone[at]shaw.ca

Thank you!

"Teranet said Victoria’s index fell 3.2 per cent in March, the biggest one-month drop for the city in nearly 23 years of data recording."

Indeed we need to put an exclamation mark at the end of that statement. Afterall, Teranet's index is put together by Canadian banks, who, of course, have an interest in keeping house prices high.

So far the year to date price drop for Victoria is down -3.20% (to the end of March). Annualizing that rate puts Victoria's price drop at -12.80% (in one year).

Unfortunately Canada doesn't have a completely independent group to calculate price changes in real estate (the US has the Case Shiller index). A Canadian index generated by such a group would be valuable.

April's median and average numbers for Victoria went a bit higher. Most of us on this site know that one month's data doesn't make or break a market. Indeed the median and average have been trending down for all areas of Victoria for many months. This break is normal in a down market.

When the median and average numbers for one month jump a bit in a down market it doesn't mean that the market has turned around. More than likely it suggests that, for any given area, the houses that sold were houses that were the most valuable (biggest, best lots, etc.) These houses could have sold for a discount and still pushed the median and average higher for that area, which is what I think happened.

April is, arguably, the most important month of the year for real estate sales. I think a lot of sales were move-up sales, particularly by owners of average to above average properties moving up to above average properties. Boomers selling their already above average home and buying their dream home would fit into this category. I think April lacked, for the most part, first-time buyers. Afterall, it isn't as easy to get a downpayment as it was before and mortgages are harder get these days (although Canadian household and mortgage debt is still climbing).

It wouldn't surprise me to see the median and average numbers for May to be higher than January and February again. This happens virtually every year in many cities. Teranet's numbers certainly show this. It would all be perfectly normal in terms of how a bubble housing market deflates.

Post a Comment